Shriram Transport Finance NCD Jan 2019 Public Issue: Details, Features, Credit Rating, Reasons to Invest, Price, Date, Allotment, Listing, Reviews, Status & How to Apply?

Shriram Transport Finance Company Limited NCD

Non-convertible debentures are one of the fixed income options that can ease investor’s hunger for greater profits

Shriram transport finance NCD is all set to issue NCD on 7th January 2019. Yes, you have heard it right! The company is proposing to offer latest NCD issue 2019.

Shriram transport finance NCD is open for subscription on 7th January 2019 & the company is going to offer NCD at 9.7 interest rate

In order to gain more key details regarding the Shriram transport finance, NCD read us till the end

Who should invest in Shriram finance NCD, What are the risks factors should be considered before investing in such high risks Non-convertible debentures

So, without much ado, let’s get started!

In this post, the following key topics are detailed

- About Shriram Transport Finance limited (STFL)

- Key Features of Shriram Transport Finance limited

- What is the credit rating of this issue?

- How the company is doing in terms of profit

- The reason, why should invest in Shriram transport finance, limited NCD

- Why not invest in

- How to apply in Shriram transport finance NCD?

- Checklist

- Shriram Transport NCD July 2019

What is a Debenture?

The debenture is long-term unsecured issued loan issued by the company.

Yes, their only creditworthiness can only be judged by the credit ratings and reputation of the company.

Company or government use debentures to borrow the money

Debentures are only the loan taken by the company it does not provides the right of ownership in the company.

What is NCD?

Debentures are categorized in two categories 1. Convertible 2. Non-convertible debentures. Convertible debentures are those which can be converted into equity and shares at a later time.

In the case of non-convertible debentures, they are not converted into equity shares.

An NCD can be secured or unsecured. Secured NCD are usually those non-convertible debentures that are backed by the issuer’s company asset to fulfill the debt obligation

About Shriram Transport Finance limited

Shri ram is one of the well known and largest assets financing non-banking finance companies NBFC in the organized sector in India that cater to the requirements of first-time buyers and the small road transport operators.

The Company has been registered as a deposit-taking NBFC with the Reserve Bank of India (RBI) since 4 September 2000.

The Assets Under Management has grown from Rs 79,489.59 crores as of March 31, 2017, on a standalone basis to Rs 95,306.02 crores (comprising assets under financing activities of Rs 80514.15 crores and loan assets securitized and assigned of Rs 1,4791.87 crores) as of March 31, 2018, on a standalone basis. The Net NPA as a percentage of Net Loan Assets was 2.83% and 2.66% as of March 31, 2018, and March 31, 2017, respectively.

The company is one of the largest players in commercial vehicle finance, which came into existence in the year 1979.

Let us dig a little deeper the company STFC was set up with the strong mission of offering the common man a variety of needful products and services that would be helpful to him on his path to wealth

Over the decades, the company has witnessed success and tremendous growth

They also provide financing for passenger commercial vehicles, multi-utility vehicles, three-wheelers, and tractors as well as ancillary equipment and vehicle parts, finance such as loans for tires and engine replacements, and provide a working capital facility for FTBs and SRTOs.

They provide financial services to the commercial website operators, thereby giving a comprehensive financing solution to the road logistics industry in India.

Shriram Transport Finance NCD Jan 2019 Public Issue – Key Features

As you all are so far aware that STFC has successfully established consistent and progressive records of over three decades in the commercial vehicle financing

Please take a look at a few important details about upcoming Shriram transport finance Jan 2019 NCD Issue (FY-2017-2019)

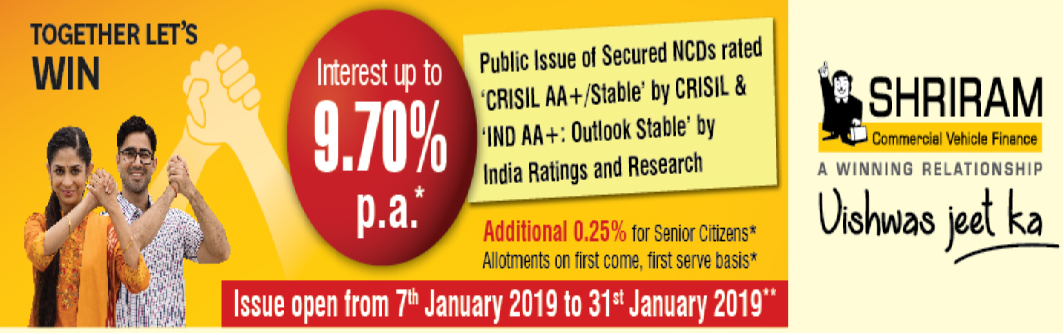

- NCD Issue Opening Date: 7th January 2019

- Issue Closes on: 31st Jan 2019.

- Interest Rate or Coupon Rate on NCDs: The ROI ranges from 9.12% to 9.70% depending on the category of investor and tenure of the NCDs.

*Interest Rates for Shriram Transport Finance Company Limited NCD:

| Series | I | II | III | IV | V | VI | VII |

| Frequency of Interest Payment | Monthly | Monthly | Annual | Annual | Annual | Cumulative | Cumulative |

| Tenor | 5 Years | 10 Years | 3 Years | 5 Years | 10 Years | 3 Years | 5 Years |

| Coupon (%) | 9.12% | 9.30% | 9.40% | 9.50% | 9.70% | NA | NA |

| Effective Yield (per annum) (Approx) | 9.50% | 9.70% | 9.39% | 9.49% | 9.69% | 9.40% | 9.50% |

| Redemption amount (Rs. Per NCD) | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1309.66 | 1574.63 |

| Put and Call option | NA | ||||||

| Redemption Date (Years from the Deemed Date of Allotment) | 5 Years | 10 Years | 3 Years | 5 Years | 10 Years | 3 Years | 5 Years |

| Minimum Application | Rs 10,000 (10 NCDs) across all Series collectively | ||||||

| In multiples of thereafter | Rs 1,000 (1 NCD) | ||||||

| Face Value / Issue Price (Rs Per NCD) | Rs 1,000 (1 NCD) | ||||||

| Mode of Interest Payment | Through various options available | ||||||

Additional Incentive: The initial allottees who are Senior Citizens on the Deemed Date of Allotment shall be considered eligible for an additional incentive of 0.25% p.a. provided the NCDs issued under the proposed Tranche are continued to be held by such individual investors on the relevant Record Date for the relevant Interest Payment Date.

Senior Citizen Applicants making online applications through electronic mode should give the copy of their PAN card by quoting their Application number, Demat Account number to the Registrar either through email/post/courier, for availing additional incentive benefit available for the Senior Citizens.

Other Senior Citizen Applicants, applying by submitting the application form physically through the Designated Intermediaries at the respective Collection Centres/ SCSBs, should enclose the copy of PAN Card along with their application, for availing additional incentive applicable for Senior Citizens.

- Issue Size: Base Issue size is Rs 200 cr (with an option to retain over-subscription amount of up to Rs 500 cr for Tranche-III.)

- Mode of Issue: Demat only

- Face Value or Issue Price of one NCD is Rs 1,000.

- Available Tenure options: 3 / 5 / 10 years.

The frequency of Interest payment: Monthly & Annual. Cumulative options are also available for 3 / 5 year NCD Series.

Minimum Application size: Rs 10,000 (10 NCDs) and in multiples of Rs 1,000 thereafter.

Listing: The NCDs are proposed to be listed on NSE & BSE stock exchanges.

Security & Asset Cover: The Company and Promoter will create and maintain appropriate security in favor of the Debenture Trustee for the NCD Holders on the assets adequate to ensure required asset cover for the Secured NCDs.

Credit Ratings: The NCDs have been rated ‘CRISIL AA+/Stable’ by CRISIL for an amount of up to Rs. 5,000 Crores and ‘IND AA+: Outlook Stable’ by India Ratings and Research for an amount up to Rs. 5,000 Crores.

| IIFL NCD Jan 2019 | HDFC NCD JAN 2019 |

| IB Consumer Finance NCD | ECL Finance NCD DEC 2018 |

| Mahindra Finance NCD 2019 | Manappuram Finance NCD 2019 |

PUT & Call options: No Put & Call options are available. (What are Put & Call options? – NCDs can have Put or Call options. If a company issues a ‘Callable Debenture’, it means that it can be redeemed by the Issuer (company) before the bond’s maturity. In such a case, an investor has to surrender the debentures back to the issuer.

A debenture with a ‘Put option’ function exactly the opposite manner, wherein the investor can sell the bond to the issuer at a specified price before its maturity.)

Allotment of NCDs is on ‘first come, first serve’ basis.

NRIs are not eligible to apply to this NCD issue.

What is the Credit rating of the STFC NCD issue?

This NCD is rated as CRISIL AA+/Stable by the crisil ratings and IND AA+Outlook by IND ratings which clearly says that these NCDs have a high degree of safety regarding timely servicing of financial obligation and carry low credit risk. Isn’t it applauding

How the company is doing in terms of profit

The Assets Under Management has grown from Rs 79,489.59 crores as of March 31, 2017, on a standalone basis to Rs 95,306.02 crores (comprising assets under financing activities of Rs 80514.15 crores and loan assets securitized and assigned of Rs 1,4791.87 crores) as of March 31, 2018, on a standalone basis. The Net NPA as a percentage of Net Loan Assets was 2.83% and 2.66% as of March 31, 2018, and March 31, 2017, respectively.

| How to Invest in Share Market? | Best Discount Broker in India |

| Share Market Introduction | How to open Demat Account? |

The reason why should invest in Shriram transport finance limited

- One of the leading name in the largest asset financing nonbanking corporation

- Rated by crisil as AA+ Which specifies that these NCD have a higher degree of safety

Why not invest in these Shriram transport finance limited NCD?

Every coin has two sides. Likewise, it is both profitable and risk to pool in your funds in nonconvertible debentures. And, the reason could be the following

- With higher returns comes the higher risks

- Do not go by the lucrative returns always check the credit worthiness’ and credit rating of the company

- An investor must pre-check certain factors before investing

How the NCD issue is allocated to various investors?

Are you pondering regarding how the NCD issue is relocated to various investors?

- Retail portion-40% of the issue

- HNI-40% of the issue

- Qualified institutional portion-10% of the issue

- Corporate portion-10% of the issue

Considerations before investing in NCDs:

There are few factors that have to be taken care of before investing your hard-earned money in NCD investment, such as

Let us find out, what are those factors

- Ratings and safety

- Company backgrounds

- Taxation and TDS

- Rate of returns

Always take a well-informed decision supported by experts and knowledge. Lack of knowledge and lure can land you in trouble. As the experts say risk comes by doing what you don’t know.

An investment in knowledge pays the high interest-remember always.

How to Apply in Shriram Transport Finance NCD?

Shriram Transport Finance NCD Issue of Jan 2019 is available in only in demat form. You can apply online or through any of the broker website where you are maintaining a demat account.

Final words

In today’s scenario, it is worth investing or parking your surplus if the issue has great credit ratings, offering lucrative interest as compared to fixed deposit or any other term deposit.

I hope you find the detailed information about Shriram transport finance NCD of valuable assistance.

Write to us, if have any suggestion for us.

Do not forget to like and subscribe to us. stay tuned for another update

Thanks for reading & have a wonderful day.

| MUTUAL FUND Basics | Best Mutual Fund for Ladies |

| Best Retirement Mutual Funds Schemes | What is IPO? & How it works |

| Best Mutual Fund for Child Education | Best Tax Saving Mutual Funds |