Shriram Transport Finance NCD January 2020 Public Issue: Details, Features, Credit Rating, Reasons to Invest, Price, Date, Allotment, Listing, Reviews, Status & How to Apply?

Greetings Investors 🙂

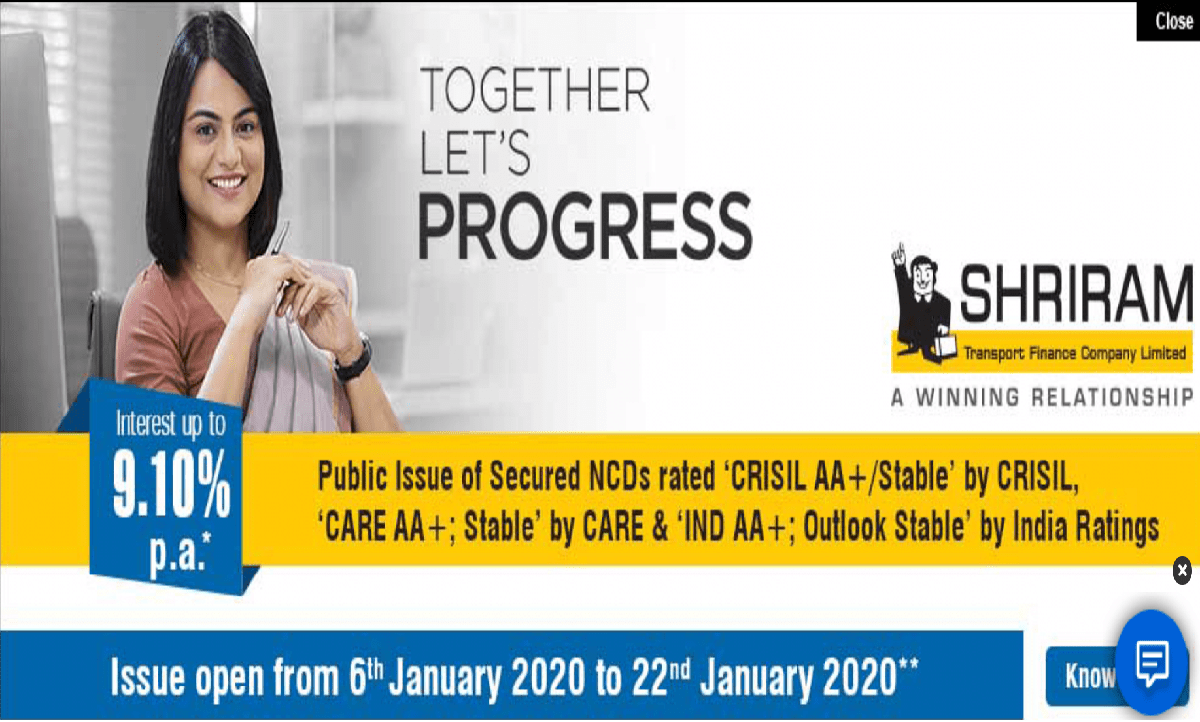

Our today’s post is contributed to Shriram Transport Finance Company Ltd NCD. Yes, the company is all set to propose NCD @ 9.10%.

In the year 2020, there is a huge flood of non-convertible debentures. Compared to the fixed deposit, these NCD proffers high-interest rates.

Shriram Transport Finance company is a part of the Shri ram group of companies which has a powerful presence in the financial services in India inclusive of commercial vehicles consumer finance, life and general insurance, stockbroking, chit funds and distribution of financial products, such as life and general insurance products and mutual fund products.

The company came into existence in the year 1979. It has a long pathway record of over three decades in the commercial vehicle financing industry in India.

In addition, it proffers commercial vehicle finance industry in India for FTBs and SRTOs

Interested investors are intrigued to know the Shriram transport finance limited NCD

Stay Tuned to learn in-depth about the Shriram Transport Finance Company NCD

Instrument – Secured Redeemable NCDs of face value Rs 1,000 each

Issue Size – Rs. 200 Crores (“Base Issue Size”) with an option to retain oversubscription aggregating up to 1,000 Crores (“Tranche 2 Issue Limit”) which is within the Shelf Limit of Rs. 10,000 Crores.

Credit Rating – ‘CARE AA+; Stable’ by CARE, ‘CRISIL AA+/Stable’ by CRISIL and ‘IND AA+; Outlook Stable’ by India Ratings

Tenor – 3 Years (Series I, IV, VII) /5 Years (Series II, V, VIII)/7 Years (Series III, VI)

Coupon – 8.52% to 9.10 % p.a. (Coupon payment varies series wise and is on monthly, annually and cumulative basis )

Incentive for Senior Citizens – Additional 0.25% p.a. for senior citizen

Submission of Application Form – Through ASBA only.

About Shriram Transport Finance

Shriram Transport Company is a chief asset financing company. The company services to first-time buyers and small road transport operators in the organized sector in India.

The company has a worldwide network of branches across India. It has 1213 branches including in most of the commercial hubs.

It is also forging the robust existence in 862 rural areas with an aim to enhance the market shares in the pre-owned commercial vehicle market.

The company is strategically amplifying its market segments and operation by signing a revenue-earning agreement.

Shriram Transport Finance NCD Jan 2020 Detail

Shriram Transport Finance Company Limited NCD – Issue Details:

| Issuer | Shriram Transport Finance Company Limited | |

| Issue Type | Secured Redeemable Non-Convertible Debentures | |

| Issue Period | Issue Opens: Jan 6, 2020 | |

| Issue Closes: Jan 22, 2020 | ||

| Coupon Rate | 9.10% p.a * | |

| Issue Size | Base Issue of Rs. 200 Crores with an option to retain oversubscription aggregating up to Rs. 10,000 Crores (“Tranche I Issue Limit”) (“Tranche I Issue”), which is the Shelf Limit | |

| Face Value | Rs. 1,000 per NCD | |

| Minimum Application Size | 10 NCDs (Rs. 10,000) and in the multiple of One NCD thereafter | |

| Credit Rating | ‘CARE AA+; Stable’ by CARE, ‘CRISIL AA+/Stable’ by CRISIL and ‘IND AA+: Outlook Stable’ by India Ratings | |

| Mode of Allotment & Trading | In Dematerialised Form | |

| QIB | 10% of the issue size | |

| Corporate | 10% of an issue size | |

| HNI | 40% of an issue size | |

| Retail Individual | 40% of an issue size | |

| Listing | NSE and BSE | |

| Depositories | NSDL & CDSL | |

| Registrar | Integrated Registry Management Services Private Limited | |

| Book Running Lead Managers | JM Financial Limited, A. K. Capital Services Limited and SMC Capitals Limited | |

Offical details download link:- https://www.stfc.in/wp-content/uploads/2020/01/STFC-Tranche_2-Roadshow.pdf

Interest Rate of Shriram Transport Finance NCD 2020

Interest rates for series 1 to 8

| Series 1 | Series 2 | Series 3 | Series 4 | Series 5 | Series 6 | Series 7 | Series 8 | |

|---|---|---|---|---|---|---|---|---|

| Frequency of Interest Payment | Monthly | Monthly | Monthly | Annually | Annually | Annually | Annually | Cumulative |

| Tenor | 3 Years | 5 Years | 7 Years | 3 Years | 5 Years | 7 Years | 3 Years | 5 Years |

| Coupon Rate | 8.52% | 8.66% | 8.75% | 8.85% | 9.00% | 9.10% | NA | NA |

| Amount on Maturity | Rs 1,000 | Rs 1,000 | Rs 1,000 | Rs 1,000 | Rs 1,000 | Rs 1,000 | Rs 1,289 | 1,539 |

What is the Issue break up?

NCD Allocation Ratio

NCD’s allocated in each investor category:

NCD’s Offered

NCD’s offered in each investor category:

| Category | NCD’s Reserved |

|---|---|

| Category 1 (QIB) | 300,000 |

| Category 2 (NII) | 300,000 |

| Category 3 (HNI) | 1,200,000 |

| Category 4 (RII) | 1,200,000 |

| Total NCD’s | 3,000,000 |

How is the company doing in terms of financials?

It is very important for the investors to look upon the financials of the company. The Financial statement of the company says a lot about the company.

The meaningful analysis and interpretation, balance sheet, income statement is the groundwork for the investor choice.

Financials for 6 months ended Sept 2019

P&L Metrics (INR Crores) Sept 30 2019 (Unaudited)

- Revenue from Operations 8,271.39

- Other Income 10.08

- Total Income 8,281.47

- Total Expenses 6,373.02

- Profit before Exceptional Items 1,908.45

- Exceptional Items –

- Profit before Tax 1,908.45

- Profit after Tax 1,399.30

- EPS (Rs) 61.68

Balance Sheet Metrics (INR Crores) Sept 30 2019 (Unaudited)

- Total AUM 1,08,120.24

- Total Equity 17,039.68

- CRAR (%) 20.35%

- Debt -Equity Ratio 5.32

Shriram Transport Financials for FY 2019

P&L Metrics (INR Crores) FY 2019 (Audited)

- Revenue from Operations 15,522.44

- Other Income 23.26

- Total Income 15,545.70

- Total Expenses 11,767.43

- Profit before Exceptional Items 3,778.27

- Exceptional Items –

- Profit before Tax 3,778.27

- Profit after Tax 2,563.99

- EPS (Rs) 113.01

Balance Sheet Metrics (INR Crores) FY 2019 (Audited)

- Total AUM 1,04,482.27

- Loan assets assigned 2,174.79

- Total Equity 15,836.28

- Book Value per share (Rs.) 697.99

- ROA (%) 2.53%

- ROE (%) 17.44%

- CRAR (%) 20.27%

- Debt -Equity Ratio 5.55

Indeed the company has robust financial and operating performance contemplated in strong growth, asset quality and returns.

Shriram Transport NCD Credit Rating Details

The NCD proposed to issue under this issue has been rated ‘CARE AA+; Stable’ by CARE Ratings Limited (“CARE”) for an amount of up to Rs. 10,00,000 lacs vide its letter dated June CRISIL AA+/Stable’ by CRISIL Limited (“CRISIL”) for an amount of up to Rs. 10,00,000 lacs vide its letter dated June 26, 2019, and ‘IND AA+; Outlook Stable’ by India Ratings and Research Private Limited (“India Ratings”) for an amount of up to Rs. 10,00,000 lacs vide its letter dated June 25, 2019.

The rating of the NCDs by CARE, CRISIL and India Ratings indicate that instruments with this rating are contemplated to have a great degree of safety in terms of timely servicing of financial obligations and have very low credit risk.

| How to Invest in Share Market? | Best Discount Broker in India |

| Share Market Introduction | How to open Demat Account? |

Why Invest in Shriram Transport Finance Company?

Holla Investors

Below, I have envisaged why the investor should consider investing in Shri Transport Company

so, let’s take a read

- One of the finest and largest NBFCs in India

- The company enjoy the robust financial rapport

- The performance of the Shriram transport finance company is reflected in the growth, asset quality and return

- Proficient in credit appraisal and collection processes

- Strong brand name and pathway of strong financial performance

- Flagship company of the Shriram Group’s financial services business.

- Among Leading player in organized CV financing segment for first time buyers and small road transport operators in India with Assets Under Management (AUM) of Rs. 1,08,120.24 Crores as on September 30, 2019

- Pan-India presence with 1,545 branches and 838 rural centres as on March 31, 2019

- Rs. 200 Crores (“Base Issue Size”) with an option to retain oversubscription aggregating upto 1,000 Crores (“Tranche 2 Issue Limit”) which is within the Shelf Limit of Rs 10,000 Crores.

- Tenor – 3 Years (Series I, IV, VII) /5 Years (Series II, V, VIII)/7 Years (Series III, VI)

- Coupon: 8.52% to 9.10% p.a. (Coupon payment varies series wise and is on monthly, annual and cumulative basis)

- NCDs rated ‘CARE AA+; Stable’ by CARE, ‘CRISIL AA+/Stable’ by CRISIL, and ‘IND AA+; Outlook Stable’ by India Ratings

- 80% of the issue is allocated for Individuals (Retail and HNI)

- Additional 0.25 % p.a. for senior citizen

- Issue opens on: Monday, January 6, 2020

- The issue closes on: Wednesday, January 22, 2020*

How to apply Shriram Transport Finance NCD

Interested Investor can proceed to buy Shriram Transport Finance Company Ltd you are required to submit the application to your bank/broker

The bank needs to be SCSB (Self-certified syndicate bank).

One can also submit the form online.

If you have a Demat account, go to IPO/NFO/NCD section and apply for the same.

The procedure of applying NCD would be through ASBA (Your amount would be blocked at first and upon allotment, your amount would be deducted and NCD allotment would be done, else your amount would be unblocked) You can approach out to any of the lead managers websites to know more details on how to apply them.

Company Promoters

The Promoter of the company is Shriram Capital Limited.

What are the Objects of the Issue:

- General corporate lending purpose

- The prime object of the issue could be onward lending, financing and for repayment/prepayment of interest and the principal of existing borrowings of the company

Key Strengths

- One of the well known and renowned asset financing NBFC

- Long term industry

- Qualified Senior management team of professionals

- Specific Bussiness Model with a powerful brand image and the pathway of strong financial performance

- Immense experience and expertise.

- Diversified funding resources with the majority are been met through term loans and working capital loans from banks (including cash credit and external commercial the issue of redeemable non-convertible debentures, as well as deposits (including public and corporate deposits) and bonds in the overseas market.

Company Contact Information

Shriram Transport Finance Company Ltd

Mookambika Complex, 3rd Floor,

No. 4, Lady Desika Road,

Mylapore, Chennai, Tamil Nadu- 600004Phone: +91 44 2499 0356

Email: stfcncd8comp@stfc.in

Website: http://www.stfc.in

Shriram Transport Finance NCD January 2020 Registrar

Integrated Registry Management Services Private Limited

2 nd Floor,

Ramakrishna Street, North Usman Road,

T. Nagar, Chennai – 600 017

Phone: + 91 44 2814 0801 to 803

Email: stfcipo@integratedindia.in

Website: http://www.integratedindia.in/

Final Words

Dear Investors

Always remember that

“Price is what you pay. Value is what you get.”

Shriram Finance Limited is one of the largest financings asset financing non-banking finance companies in the organized sector in India that serve to first-time buyers (“FTB”) and small road transport operators (“SRTOs”) for financing preowned commercial

vehicles.

I hope you have found this post about Shriram NCD Issue Details 2020 Details significant.

We at Investor’s academy aims at empowering financial awareness among our readers and viewers so that they can make better investment decisions.

| MUTUAL FUND Basics | Best Mutual Fund for Ladies |

| Best Retirement Mutual Funds Schemes | What is IPO? & How it works |

| Best Mutual Fund for Child Education | Best Tax Saving Mutual Funds |

Frequently Asked Questions

The Shriram Transport Finance NCD Jan 2020 issue opens on Jan 6, 2020, and closes on Jan 22, 2020, for the subscription.

Note that the public issue of NCD is closed early in case it is fully subscribed (base + shelf) before its issue closing day. The allotment is done on a First Come First Serve Basis.

Shriram Transport Finance NCD Jan 2020 price is set at ₹1000 per NCD.

The NCD’s will be issued at a face value of ₹1000 each NCD.

The frequency of payment for Shriram Transport Finance NCD Jan 2020 is 3 Years/5 Years/7 Years.

Shriram Transport Finance NCD Jan 2020 remain open for subscription on working days from 10:00 a.m. to 5:00 p.m until Jan 22, 2020. The bid may close earlier in case it is fully subscribed.

The NCD’s have a fixed maturity date. The date of maturity of the NCD’s is Annual, Cumulative, and Monthly.

The Shriram Transport Finance NCD Jan 2020 consists of a base issue and a shelf issue.

NCD Base Issue Size: ₹200.00 Crores

NCD Shelf Issue Size: ₹10,000.00 Crores

2,000,000

No, NRI’s are not eligible to apply in this Issue.

Shriram Transport Finance NCD Jan 2020 Allotment and Listing. The NCD’s are proposed to be listed on BSE, NSE.

Applicants are allocated NCD’s on a First Come First Serve Basis.

The Shriram Transport Finance Company Ltd Allotment Status will be check on the official site Shriram transport finance company.

The NCDs proposed to be issued under this Issue have been rated ‘CARE AA+; Stable’ by CARE, ‘CRISIL AA+/Stable’ by CRISIL and ‘IND AA+: Outlook Stable’ by India Ratings

It depends on many factors like company financials, segment outlook, market situation, issue pricing, the background of promoters, lead managers performance, company strengths, risks and oversubscription. You should read the prospectus document, NCD Analysis from experts and follow the subscriptions before you make the decision to apply in an NCD public Issue.

Shriram Transport Finance Company Ltd NCD listing day gains are unpredictable as it depends on many factors on the day listing. It depends on factors like the demand, the market situation on the day of listing, NCD Issue size etc.

COUPON RATE FOR JULY 2019 NCD ISSUE NOT CLEARLY LEGIBLE / IT IS SHADOWED BY SOME

OTHER WRITE UP. INCENTIVE FOR SENIOR CITIZENS ALSO NOT SEEN

PLEASE MAIL COUPON RATE FOR VARIOUS PRIODS /