Muthoot Finance Ltd NCD 2020 Public Issue: Muthoot Finance 2020 NCD Details, Features, Credit Rating, Reasons to Invest, Price, Date, Allotment Status, Listing, Reviews, Status & How to Apply?

Muthoot finance limited is a systematically important non-deposit taking headquartered in the south Indian state of Kerala.

The company has been licensed by the Reserve bank of India.

Company functional history has progressed over a period of 79 years since the M. George Muthoot (the father of the company promoters) incorporated gold loan business in 1939.

The company is the largest gold loan NBFC in terms of the loan portfolio.

The company was ranked as the largest gold loan company in India in terms of the loan portfolio as of March 31, 2019.

If we check upon the current scenarios the bank fixed deposit is giving low interest that’s why the investor considers investing high yield NCD which will fetch great returns.

NCD is the best investment option to invest your money, also the interest rate proffered by the company is hard to resist by the investors.

Today’s post is all about Muthoot Finance LTD NCD.

Yes, the company is all set to propose NCD at 7.75% interest and the face value of 1000 per NCD. Muthoot Finance NCD December 2020 Issue would open for subscription from Dec 11, 2020 to Jan 5, 2021.

Let me do Muthoot finance limited company NCD review with this post

In this post, I would provide you with some interesting insight into “Muthoot Finance NCD”.

What are Non-Convertible Debentures?

Non-Convertible debentures or the NCD do not have the option of conversion into the shares and on maturity, the principal amount along with the accumulated interest is paid to the holder of the instrument.

Nonconvertible debentures are the fixed income products that proffer comparatively great returns which are hard to resist.

Whenever a company wants to raise money from the public it issues a debt paper for a cited tenure where it pays a fixed interest on the investment. This paper is called a debenture.

It does not have the conversion of shares into the maturity the principal amount along with the interest is paid to the holder of the instrument.

| UPCOMING IPO 2021 | UPCOMING DIVIDEND |

| UPCOMING BUYBACK | UPCOMING NCD 2021 |

| Best Stocks to buy | Best Share Trading App In India |

About Muthoot Finance LTD

Muthoot Finance LTD is the largest gold loan NBFC based on the loan portfolio in India. The company provides personal and business loans secured by gold jewelry, or gold loans, to individuals.

Muthoot Finance is a systematically important non-deposit taking NBFC Which is headquartered in the south Indian state of Kerala.

In counting to the gold loan, it provides money transfer services through their branches as sub-agents of various registered money transfer and also has commenced the collection agency services.

The company has a built network of 4,422 branches across 23 states, Delhi and 5 union territories in India.

The company operates 218 ATMs spread across 17 states. The target market of Muthoot Finance includes small businesses, vendors, farmers, traders, SME business owners, and salaried individuals.

The company employs 24,063 people in operation.

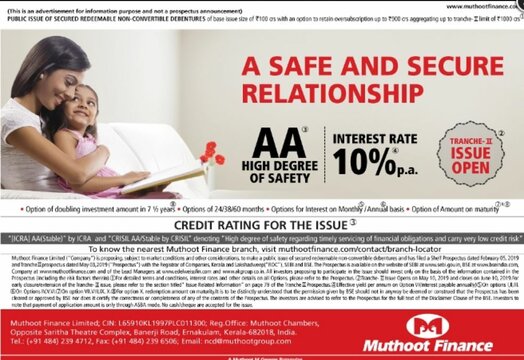

Muthoot Finance Limited NCD – Issue Details

| Issuer | Muthoot Finance Limited (View Report) | |

| Issue Type | Secured Redeemable Non-Convertible Debentures | |

| Issue Period | Issue Opens: December 11, 2020 | |

| Issue Closes: January 5, 2020 | ||

| Coupon Rate | 7.75% p.a * | |

| Issue Size | Base Issue of Rs. 100 crores with an option to retain oversubscription up to Rs. 900 crores (Tranche II Issue) | |

| Face Value | Rs. 1,000 per NCD | |

| Minimum Application Size | 10 NCDs (Rs. 10,000) and in the multiple of One NCD thereafter | |

| Credit Rating | “[ICRA] AA (Stable)” and “CRISIL AA/Stable” | |

| Mode of Allotment & Trading | In Dematerialised Form | |

| QIB | 10% of the issue size | |

| Corporate | 10% of an issue size | |

| HNI | 30% of an issue size | |

| Retail Individual | 50% of an issue size | |

| Listing | BSE | |

| Depositories | NSDL & CDSL | |

| Registrar | Link Intime India Private Limited | |

| Book Running Lead Managers | Edelweiss Financial Services Limited and A. K. Capital Services Limited | |

Features of Muthoot Finance NCD Issue DEC 2020

- Issue start date: Dec 11, 2020

- Issue end date: Jan 5, 2021

NCD’s are available in 8 different options.

The interest of these NCDs is payable monthly and yearly depending on the NCD option chosen by you.

The face value of the NCD bond is Rs 1,000.

The minimum investment is for 10 bonds means, you need to invest for a minimum of Rs 10,000. Beyond this, you can invest in multiples of 1 bond.

These NCD bonds would be listed on BSE. Hence, these are liquid investments.

Non-resident Indians (NRI’s) cannot invest in these NCDs.

ICRA has rated these NCDs as AA/Stable and CRISIL rated them as AA/Stable, which indicate that instruments with this rating are considered to have the highest degree of safety regarding timely servicing of financial obligations.

Interest Rates for Muthoot Finance NCD 2020

| Series 1 | Series 2 | Series 3 | Series 4 | Series 5 | Series 6 | |

|---|---|---|---|---|---|---|

| Frequency of Interest Payment | Monthly | Monthly | Annually | Annually | Annually | Annually |

| Tenor | 38 months | 60 months | 38 months | 60 months | 38 months | 60 months |

| Coupon Rate | 7.15% | 7.50% | 7.40% | 7.75% | 7.40% | 7.75% |

| Amount on Maturity | ₹1,000 | ₹1,000 | ₹1,000 | ₹1,000 | ₹1,239 | ₹1,425 |

What is the Issue break up?

- QIB Portion- 10% of the issue size

- Corporate Portion- 10% of the issue size

- HNI- 30% of the issue size

- Retail Investors- 50% of the issue

How is the company doing in terms of financials?

It is very significant for investors to gauge the financial summary of the company. The company’s gold loan business constitutes more than 99 percent of its total income. Its retail loan assets stand at Rs. 23,763 Crs.

The total number of shares of Muthoot Finance held by Individuals/Hindu Undivided Family stood at 80.12 percent and the public shareholdings from Mutual Funds/UTI totaled 3.52 percent.

Here are the financials:

- Its revenues grew from Rs 5,747 Crores in FY 2017 to Rs 6,243 Crores in FY2018.

- Its profits grew from Rs 1,180 Crores in FY 2017 to Rs 1,720 Crores in FY2018.

- Its Gross NPA is at 1.9% as of 30th September 2018.

Why Invest in Muthoot Finance Limited NCD?

- The interest rate offered by the company is lucrative

- The company enjoys great credit rating by “[ICRA] AA (Stable)” and “CRISIL AA/Stable”

- As per section 193 of the Income Tax Act, NCDs are not subject to TDS, Yes, there is no tax on the income of interest on NCDs

- Easy liquidity.

Why not to invest in Muthoot Finance NCD 2020?

Below I have stated a few valid reasons for the same

- Gold finance companies are at high risk and perilous. degradation in loan business can pose a threat to the company’s business

- There could be a delay in interest and repayment of principal on the maturity period

- The interested investors can refer to all the risk factor in the company’s prospectus

How to apply Muthoot Finance NCD Issue of 2020?

One can apply to these NCD is a Demat form only, as there would be no interest on the non-convertible debentures.

If you have a Demat account, go to IPO/NFO/NCD section and apply for the same. The procedure of applying NCD would be through ASBA (Your amount would be blocked at first and upon allotment, your amount would be deducted and NCD allotment would be done, else your amount would be unblocked)

You can approach out to any of the lead managers websites to know more details on how to apply them.

| Share Market Basics | Best Share Trading Apps 2021 |

| Best Discount Broker in India | Top Stock Research Sites India |

| How to Invest in Share Market? | Best Books for Stock Market |

How Muthoot Finance 2020 NCD are taxed?

It’s irrelevant that whether the company would deduct TDS or not, one has to divulge the interest in the income tax returns and pay the tax as per the tax bracket.

When this Muthoot Finance NCD of 2020 would get listed on BSE?

These Muthoot Finance NCD of December 2020 would get listed after the 6 working days from the date of closure. Means it would get listed approx. on January 2021.

Who are the company promoters?

- M.G George Muthoot

- George Alexander Muthoot

- George Thomas Muthoot

- George Jacob Muthoot

The object of the Issue

The Net Proceeds raised through the Tranche II Issue will be utilised for following activities in the ratio provided as below:

1. For the purpose of lending: minimum of 75% of the amount raised and allotted in the Issue

2. For General Corporate Purposes: shall not exceed 25% of the amount raised and allotted in the Issue

Ratings

The issue is rated ICRAA/ Stable and CRISIL AA/stable. The rating by ICRA and CRISIL has specified the high degree of safety, regarding timely servicing of the financial obligation

Offerings

NCD has tenure of 24 months, 60 months and 90 months. It offers coupon rates ranging from 9.25% to 10.00% based on the tenure and the interest payment option.

Company Contact Information

Muthoot Finance Limited

Muthoot Chambers,

Opp Saritha Theatre Complex, 2nd Flr,

Banerji Road, Kochi 682 018

Phone: (+91 484) 239 4712

Email: ncd@muthootgroup.com

Website: http://www.muthootfinance.com

Muthoot Finance NCD Registrar

Link Intime India Private Ltd

Link Intime India Private Ltd

C 101, 247 Park, L.B.S.Marg,

Vikhroli (West), Mumbai – 400083

Phone: +91-22-4918 6270

Email: mfl.ncd2020@linkintime.co.in

Website: http://www.linkintime.co.in

Final Words

Dear Readers

There is a cascade of non-convertible debentures even after IL&FS Scam, and ZEE entertainment group.

Secured Nonconvertible debentures are considered somewhat better than the secured debentures.

I hope you had a great time reading about “Muthoot Finance NCD”

Readers do you feel these NCDs are worth investing. However, you should be willing to take the risks indicated above

If you find this information useful please share it with others via Facebook and Twitter.

| MUTUAL FUND Basics | Best Mutual Fund for Women |

| Best Retirement Mutual Funds | What is IPO? & How it works |

| Best Mutual Fund for Children | Best Tax Saving Mutual Funds |

The Muthoot Finance NCD Dec 2020 issue opens on Dec 11, 2020, and closes on Jan 5, 2021, for the subscription.

Muthoot Finance NCD Dec 2020 price is set at ₹1000 per NCD.

The NCD’s will be issued at a face value of ₹1000 each NCD.

The frequency of payment for Muthoot Finance NCD Dec 2020 is Monthly or Annual.

Muthoot Finance NCD Dec 2020 remain open for subscription on working days from 10:00 a.m. to 5:00 p.m until Jan 5, 2021. The bid may close earlier in case it is fully subscribed.

The NCD’s have a fixed maturity date. The date of maturity of the NCD’s is 38 months and 60 months.

The Muthoot Finance NCD Dec 2020 consist of a base issue and a shelf issue.

NCD Base Issue Size: ₹100.00 Crores

NCD Shelf Issue Size: ₹900.00 Crores