Best Performing PMS in India 2025

Whenever you invest in the share market with your personal understanding or when you are going to take your first step in the share market, you might had felt for the need of strong assistance which may support you in mining useful decisions on how to invest in stock market? which can secure your returns simultaneously.

PMS is the only preferred destination in this regard. It helps you out not only in making sensible decisions on your money but it takes a whole headache regarding your portfolio management.

In today’s discussion, the hot topic will be focused on PMS in India. Into this, we will read about-

- What is PMS?

- List of PMS in India

- Best Performing PMS in India 2025

- Types of PMS

- What are the Benefits of PMS in India (Advantages)

- Disadvantages of PMS

- How can you invest in PMS?

- Working of a PMS

- PMS Charges in India

- Taxation on PMS

- Difference between PMS and Mutual Fund

PMS In India 2025

Well! We think that there is so much to discuss on and we have less time to read. So without any single second delay, let’s proceed.

What is PMS?

PMS means “Portfolio Management Services”. Actually, every share company has this service providing facility which facilitates its customers the back-end support for managing their portfolio.

The PMS provides you the experts who are well-versed with the market happenings and they can better guide you on important investment decisions. What else they provide, let’s see below-

- They take the whole responsibility to manage your portfolio.

- They understand your requirements for what kind of returns you actually expect from your investments and in which segments you prefer to invest in.

- They track the market and invest your money keeping your requirements in their mind.

- They tend to take such decisions that can prosper your wealth tremendously.

- They advise you on whatever you are going to do in the share market.

The feature of PMS

- PMS is registered by the SEBI market regulator.

- PMS deals with Equity and debts.

- PMS services are availed by banks, brokers, independent investment managers, or AMC (Asset Management Companies).

- Actually, it is a kind of a drawback for retail or normal investors because PMS suits only to those who have a large affording power or who is a wealthy person. The PMS charges a large percentage of money from its users which are not within the capacity of a normal or average class investor. There are so many PMS in the markets that are providing such services. Their charges to manage your portfolio would really vary. Some charge 2.5 percent of the fund size, while others charge more.

- The minimum investment required to open a PMS account is Rs. 5 Lacs. However, different providers have different minimum balance requirements for different products.

- The service providers have different models portfolios for the investors which the investors can choose as per their financial goals and requirements. They can even customize them if they want some additional or want little adjustment.

When such attractive facilities are provided by the PMS then why not we will bother to know about the names of those PMSs. In the upcoming next subtopic, you will see the best performing PMS in India and also come to know about their deep insight details.

Types of PMS

There are three types of Portfolios in PMS, you can choose any of them-

- Discretionary PMS– Discretionary Portfolio provides the service provider a right to make decisions on behalf of the client, whether he wants to sell or buy the shares. He is not bounded to consult with the client.

- Non-Discretionary PMS- This is the just reverse of the above. Here, the service provider consults with his clients on investment decisions or buying and selling of shares before transacting any event. The decision making power lies in the hands of the client only. The service provider can advise and assist them with things, but the final executions will be done according to the client’s order.

- Advisory: Only advice is given. No execution.

It is to be kindly noted that most PMS provides Discretionary portfolios in India.

Top PMS Services in India 2025

PMS of India List

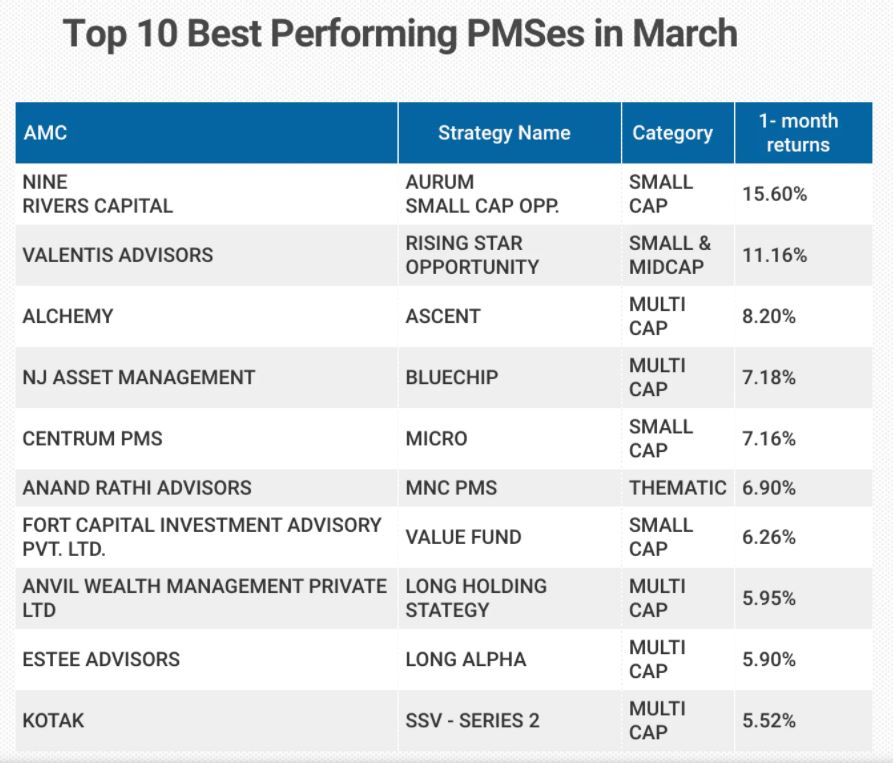

TOP 10 Best Performing PMSes in MARCH 2025

50% PMS schemes beat Nifty in March, multicap funds shine

TOP 10 BEST PERFORMING PMS 2020

The stellar performance was also visible in the returns of Portfolio Management Schemes (PMSes) as about 67 percent of them beat the Nifty.

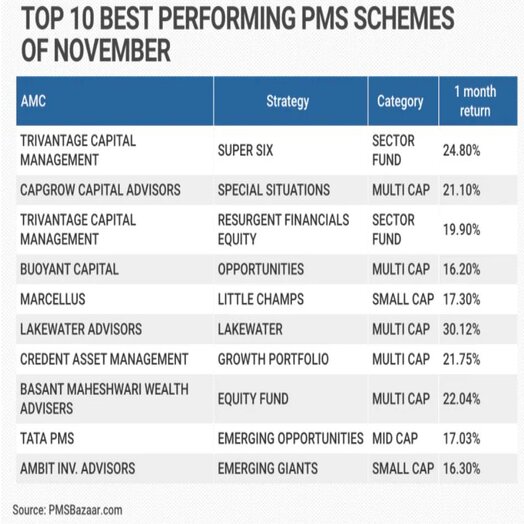

PMS Returns November 2020

Around 40% PMSes beat Nifty in November; mid and smallcaps lead the show

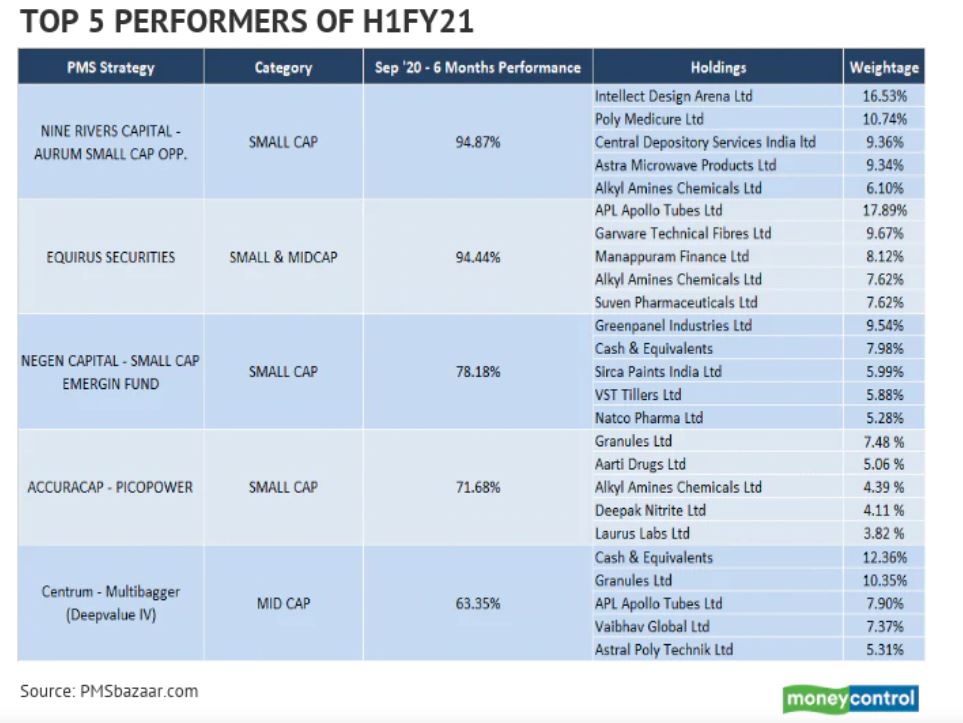

PMS Returns Last 06 Months

20 stocks from top 5 PMS schemes gave 60-90% return in 6 months

(Updated:- 29-10-2020) PMS schemes that gave more than 50 percent return include Nine River Capital’s AURUM Smallcap theme that delivered nearly 95 percent return in the last six months. Top holdings include stocks like Intellect Design, Poly Medicure, CDSL, Astra Microwave and Alkyl Amines Chemicals.

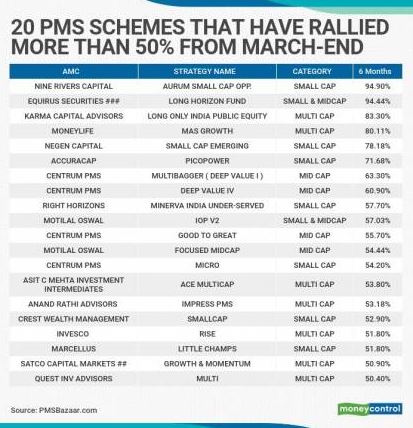

20 PMS schemes gave 50-100% return in just 6 months. (15-10-2020)

PMS Returns September 2020

Image Source: https://pmsbazaar.com/

PMS Returns August 2020

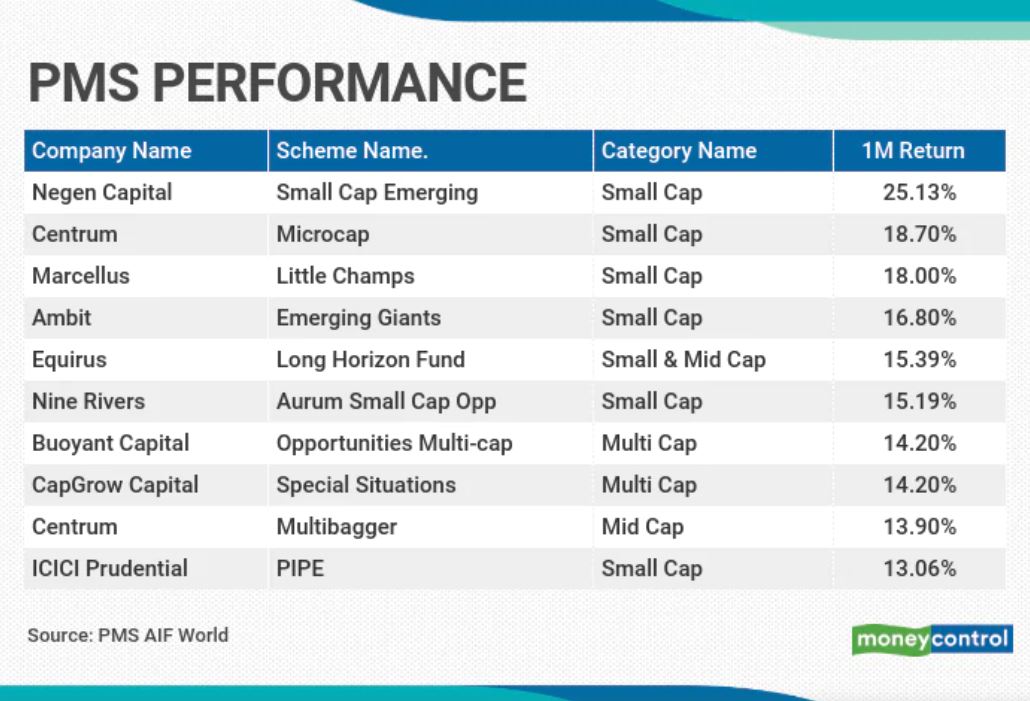

About 80% PMS schemes outperformed Nifty in August, rise up to 25% MoM

Negen Capital’s Small Cap Emerging topped the list with a whopping 25.13 percent return during August.

PMS Returns July 2020

Over 20 stocks from top 5 PMS schemes outperformed Nifty in July; worth a look?

Indian market witnessed a euphoric rally in July despite rising COVID-19 cases faltering growth statistics in India as well as across the globe. Bulls pushed benchmark indices higher by over 7 percent each, and about 40 portfolio Management Schemes (PMS schemes) delivered more than 8 percent return in the same period.

Wize Market Analytics delivered a return of 22 percent in July, outperforming other PMS schemes. The majority of the schemes that outperformed benchmark indices in July were from the mid & smallcap space.

PMS Returns June 2020

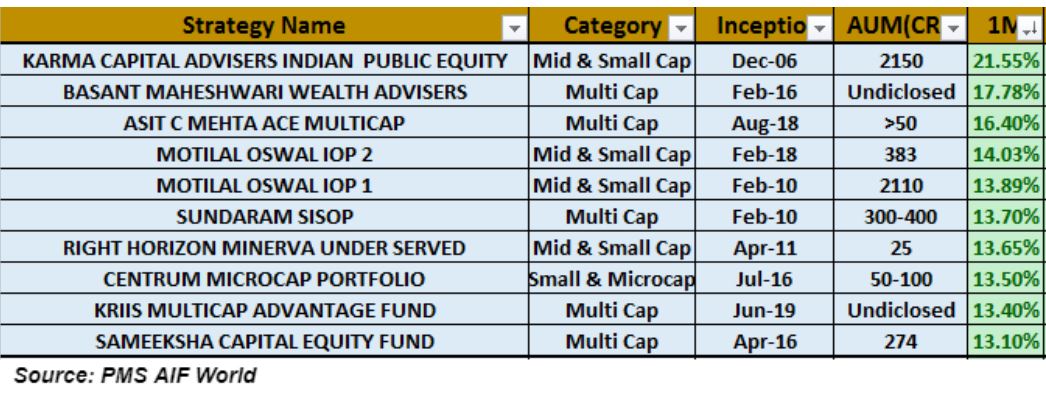

Top 10 PMSes delivered double-digit returns in June, mid & smallcap schemes flavour of the month

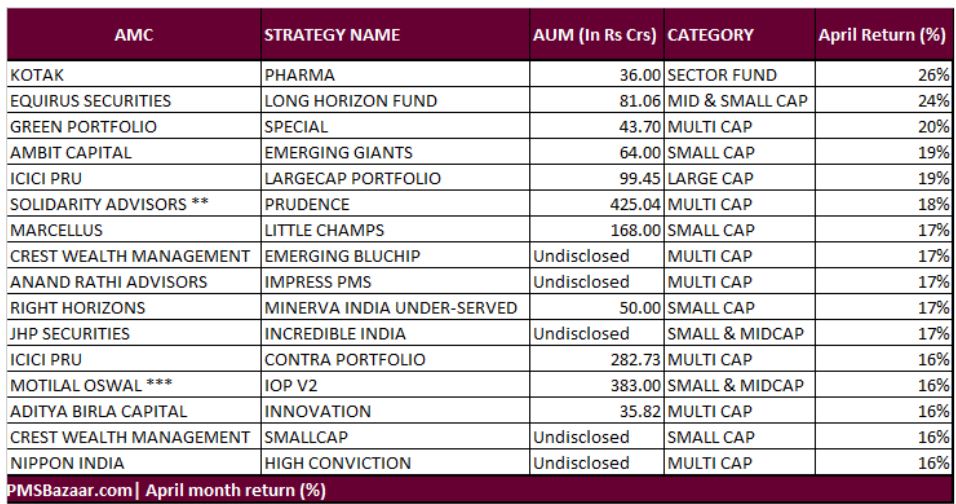

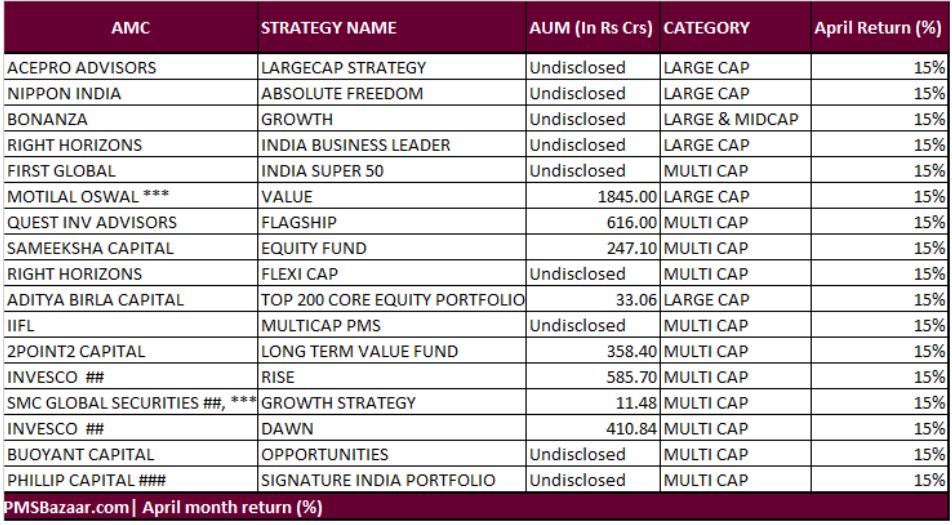

PMS Returns April 2020

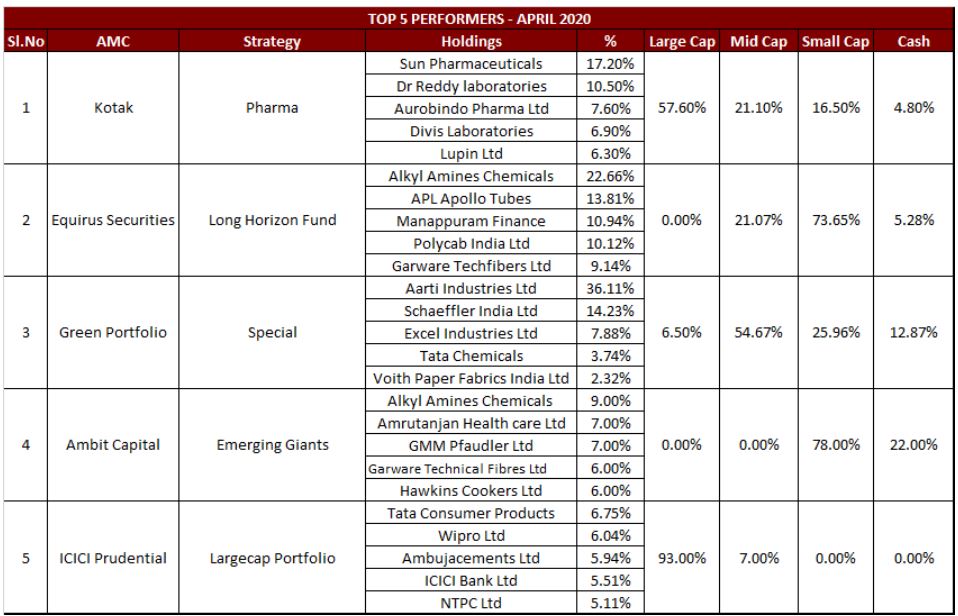

Top 5 Performers April 2020

PMS APRIL Return 2020

PMS Returns February 2020

These 9 PMSes beat coronavirus gloom to give positive returns in February 2020.

PMS Returns January 2020

Top 8 PMS schemes which have given double-digit returns in January are CapGrow Capital Advisor’s Special Situation scheme, Motilal Oswal’s IOP scheme, Centrum PMS – Micro Fund, Nippon India’s Emerging India, Ambit Capital’s Emerging Giants, Sundaram AMC’s S E L F portfolio, Centrum PMS’s Good to Great scheme and AnadRathi’s Impress PMS.

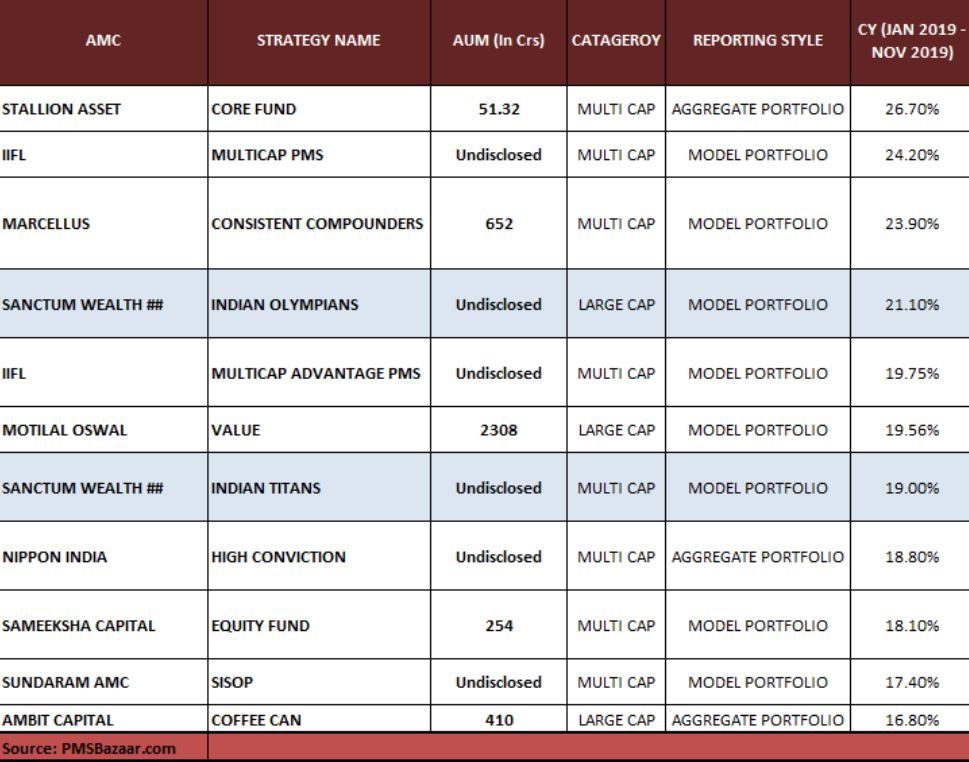

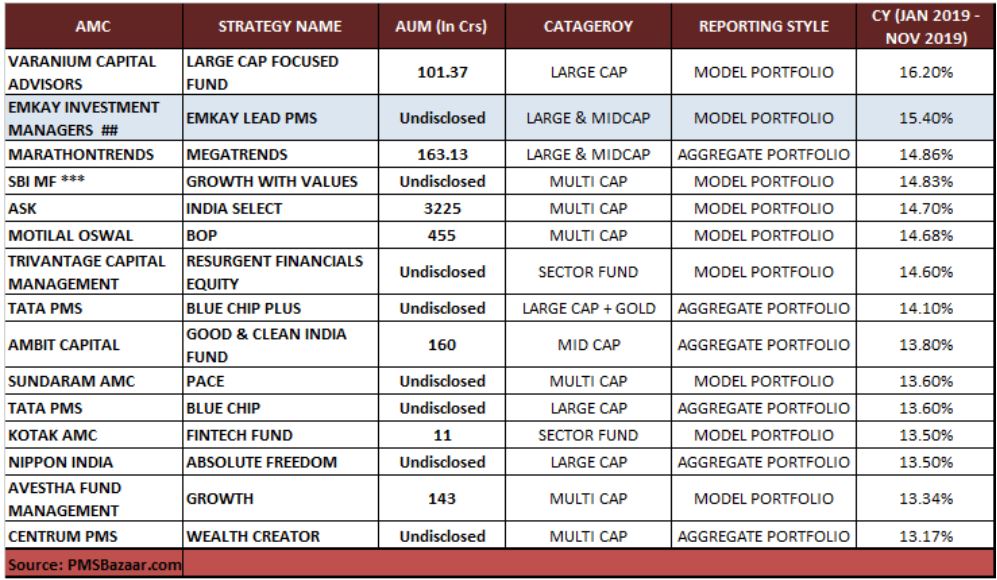

Nifty50 has risen around 13 percent so far in 2019, and as many as 26 PMS schemes across categories have managed to outperform in the same period, showed data from PMS Bazaar.

Multicap PMS Strategies Returns 2019

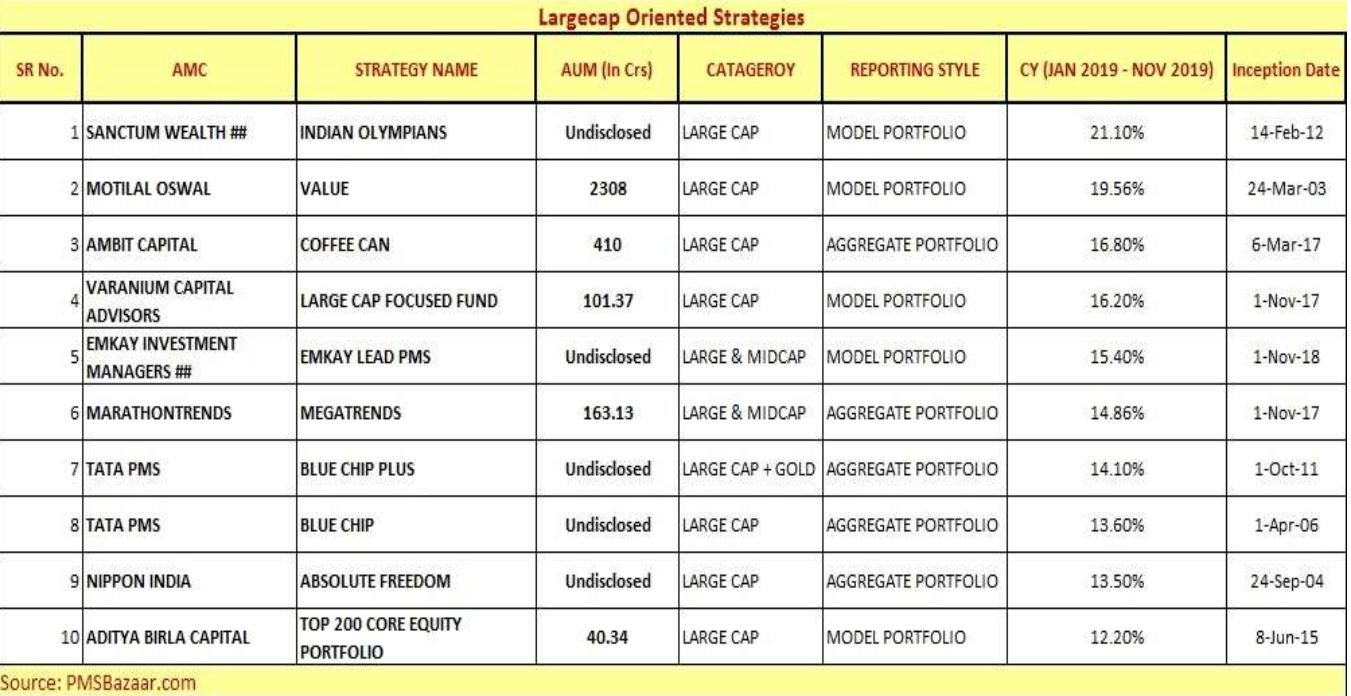

Largecap PMS Strategies Returns 2019

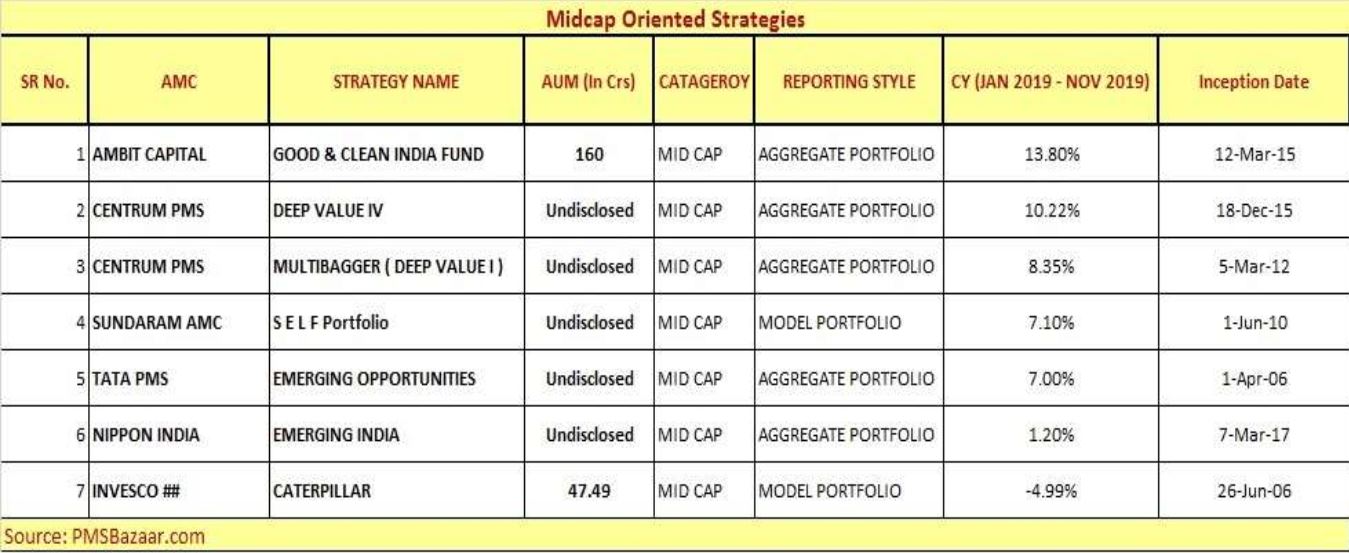

Midcap PMS Strategies Returns 2019

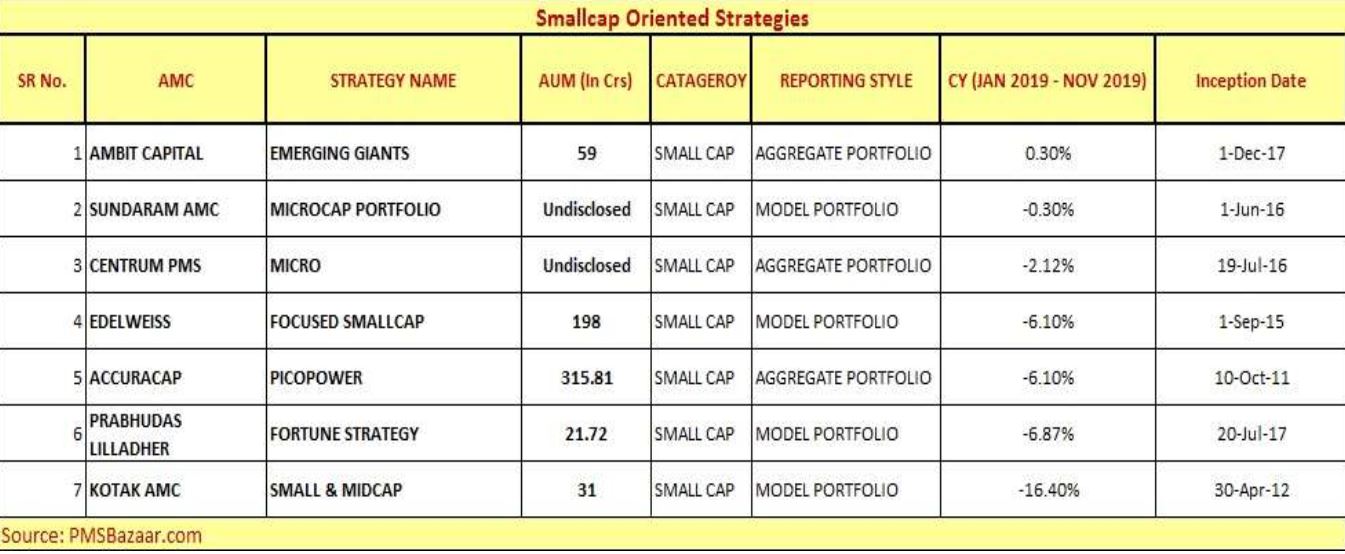

Smallcap PMS Strategies Returns 2019

Thematic PMS Strategies Returns 2019

PMS services with low risk and above 18% approx annualized return over 5 years

Ones in blue may have an issue with monthly returns.

- ALCHEMY CAPITAL MANAGEMENT PRIVATE LTD

- ANAND RATHI ADVISORS LIMITED

- SUREFIN FINANCIAL CONSULTANTS PVT. LTD

- PhillipCapital (India) Private Limited

- MOTILAL OSWAL ASSET MANAGEMENT COMPANY LIMITED

- UNIFI CAPITAL PRIVATE LIMITED

- UTI ASSET MANAGEMENT COMPANY PVT LTD

- BANYAN TREE ADVISORS PRIVATE LIMITED

- Multi-Act Equity Consultancy Pvt Ltd

- STATE BANK OF INDIA

- LIC MUTUAL FUND ASSET MANAGEMENT LTD

- ICICI SECURITIES PRIMARY DEALERSHIP LTD.

- DOHA BROKERAGE AND FINANCIAL SERVICES LTD

- IDBI CAPITAL MARKET SERVICES LTD.

PMS Returns 2019

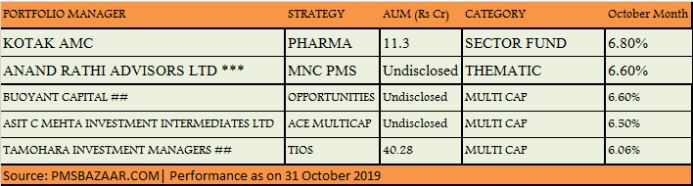

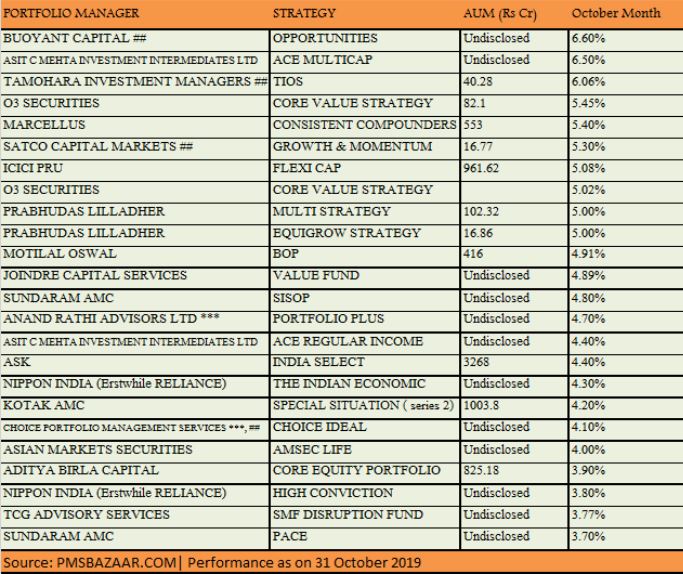

PMS Returns October 2019

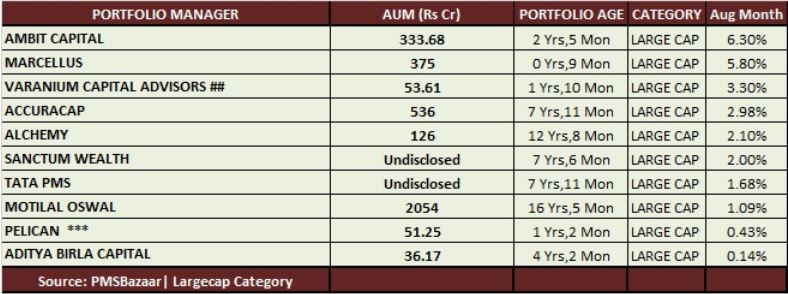

Largecap Category

Under the largecap category, as many as 4 stocks outperformed Nifty50 in October which include Ambit Capital’s Coffee Can, followed by ICICI Prudential Large Cap, Alchemy Leaders, and Accuracap’s Alpha 10.

Multicap Category

There are as many as 25 PMSes under the multicap category which outperformed Nifty in October. These include Buoyant Capital, Asit C Mehta, Tamohara Investment Managers, O3 Securities, Marcellus, Prabhudas Lilladher, Sundaram AMC, among others.

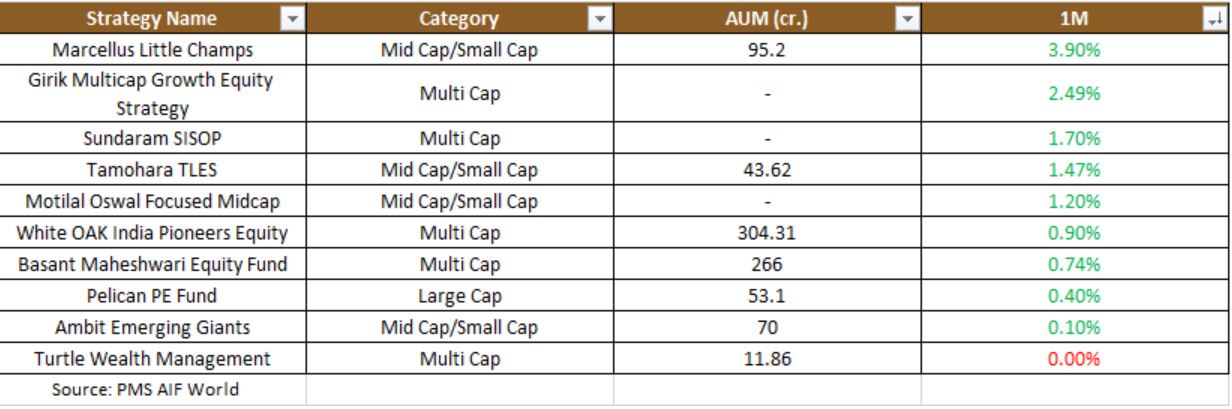

PMS Returns September 2019

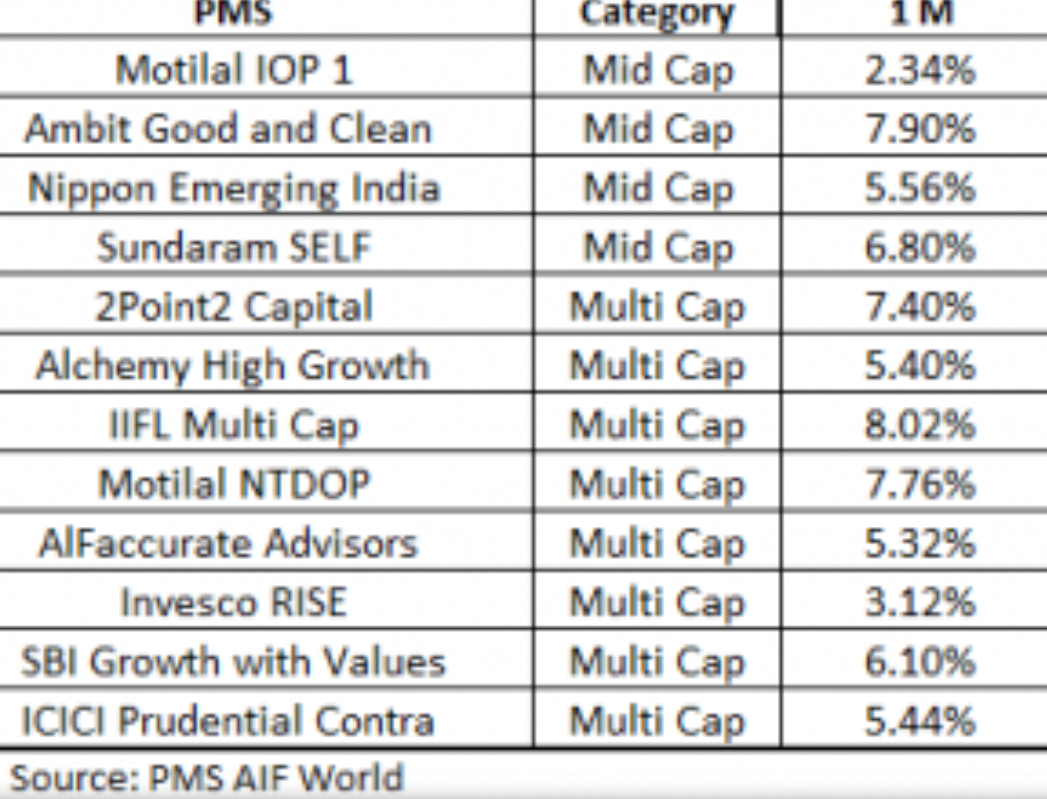

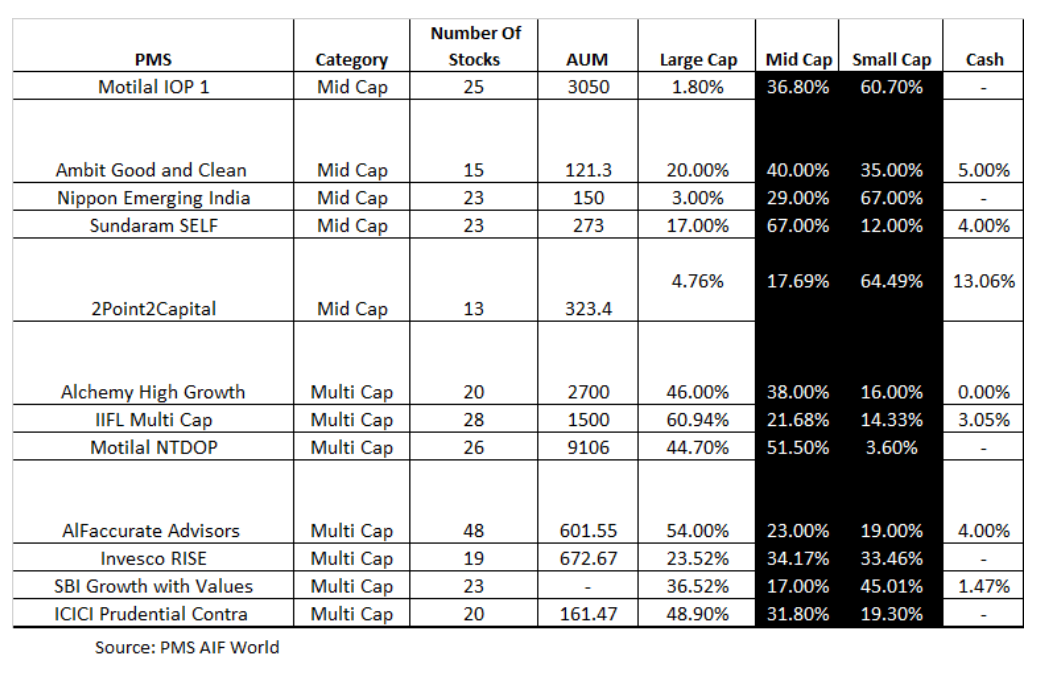

Based on the belief that midcaps might be the way going forward, research-based wealth management firm, PMS AIF World, collated a list of 12 Portfolio Management Services (PMS) schemes that have a substantial weight in midcap and multi-cap space.

All schemes generated positive returns for investors, returning 2-8 percent in September 2019.

Among the PMSes, IIFL Multicap, which manages an AUM of Rs 1,500 crore, gave the maximum return in September 2019 at 8.02 percent. The PMS’ exposure to large cap, midcap and smallcap stood at 60.94 percent, 21.68 percent, and 14.33 percent, respectively.

In the midcap category, Ambit Good and Clean gave the maximum return at 7.9 percent. The PMS manages an AUM of Rs 121.3 crore spread across largecap (20 percent), midcap (40 percent) and smallcap (3 percent).

Latest PMS Industry Updates

Source:- Economics Times

Top 10 PMS in India 2020

Porinju Veliyath Equity Intelligence PMS

This is the most powerful, leading and the largest PMS service in India. It was incorporated in the year 2002 founded by Porinju Veliyath.

The minimum investment you would need to buy this PMS is Rs 50 lakh. As per the past 5 years performance, it has been analyzed that the PMS has released the returns at the rate of 35% and in the last 1 year 47%. Isn’t it great!

There is also a piece of good news about this PMS is that there is no lock-in-period for your investment. It entertains the flexibility to their investors.it means that you can withdraw your money anytime.

There is no entry load and no exit load too.

Porinju Veliyath Equity Intelligence PMS charges 2% per annum for its management fees, 10% per annum of the returns for additional performance on it.

NRIs also can invest in this PMS of India.

Official Website:- https://www.rupeeiq.com/content/porinju-veliyaths-equity-intelligence-pms-has-annualised-returns-of-32-76/

| Upcoming NCD Issues in 2020 | Best Retirement Mutual Funds 2020 |

| Best Mutual Fund for Women’s | Best Child Mutual Fund Plans 2020 |

Motilal Oswal Next Trillion Dollar Opportunity PMS (NTDO)

Next Trillion Dollar is a PMS provider and Motilal Oswal is an AMC that is providing this PMS service also with the name of NTDO.

It generally deals with small and mid-cap stocks, so it is good for short or medium-term investors.

The minimum requirement to invest in this PMS scheme ranges is 25 lakh and these can be invested into any of the 25 stocks.

As per the past 5 year’s performance, it has been analyzed that the PMS has released the returns at the rate of 32% and in the last 1 year 19%.

NRIs can invest in this top PMS in India. After Porinju, Motilal has been considered as the second best PMS provider in India.

Official Website:- https://www.motilaloswalmf.com/products/next-trillion-dollar-opportunity

Birla Sunlife PMS

Birla Sunlife PMS is a brand service provider of Aditya Birla, which has an AMC also. The Birla Sunlife PMS was established in the year 1994, providing its services in a whole range of investment products. They generally target those businesses which are priced less but can be yielding higher returns.

It charges variable fees or minimum investment for various categories of portfolios. They are mentioned as under-

- Core-Equity Portfolio-

Minimum Rs 50 lakh of investment with a time horizon of 1 to 3 years. - Customized Debt Portfolio-

25 Crores or as per SEBI regulations for a tenure of 3 months to 3 years. - Select Sector Portfolio-

Rs 25 Crores or as per SEBI regulations for a tenure of 3 months to 3 years.

Official Website:- https://mutualfund.adityabirlacapital.com/investor-solution-portfolio-management-service

Kotak PMS

Kotak AMC PMS is one another best PMS in India which is renowned. Kotak PMS is discretionary which invests in 10-25 stocks with various investment approaches to reap the higher returns.

Kotak PMS Fees & Charges

- Kotak PMS charges a fixed management fee of 2.5% per annum payable quarterly.

- This PMS won’t charge any performance fees which is key positive for you. However, it charges exit loads at 3%,2% and 1% for exiting within 1 year,2 years and 3 years respectively.

- Also, it is been disclosed on the portal that there may be some additional charges for brokerage(0.1%), stamp duty, audit fees etc.

- Official Website:- https://assetmanagement.kotak.com/portfoliomgmt/

ICICI Prudential Portfolio Management Services

ICICI Prudential Portfolio Management Services(PMS) enjoys a rich parentage of two large organizations ICICI Bank Ltd which is India’s largest private sector bank in addition to being one of the most trusted brands in financial services and Prudential Plc UK, an international financial services company, with significant operations in Asia, US and UK.

Product Offerings

- Core Portfolio

- Large Cap Portfolio

- Flexi Cap Portfolio

- Value Portfolio

- Contra Portfolio

- Thematic Portfolio

- Infrastructure Portfolio

- Export Portfolio

- Wellness Portfolio

- PIPE Portfolio

- Absolute Return Portfolio

- Enterprising India Portfolio

Official Website:- https://www.iciciprupms.com/

ASK India Select PMS

This PMS not only deals with national citizens but also international people. To manage such a wide customer base all over the globe, there is an obvious need for a rand expertise ream, and so the ASK India has. It focuses on maximizing wealth in addition to taking care of reducing risks.

The investors can invest in any capital market like in mid-cap, short-cap, large-cap, multi-cap, value and growth and international assets.

Annually it charges 2% of the portfolio value.

There is a fixed fee of 1.5% of the portfolio and plus 20% of gains to be paid to them over and above 10% of profits. This is the performance-linked fees.

Official Website:- http://www.askinvestmentmanagers.com/

PMS Returns Large Cap Category Chart.

PMS Returns: Last 3 years

Staing month Mar 2016. Ending month Feb 2019

| PMS Name | Current Value of Rs. 1000 | Absolute Return | Standard deviation of monthly Returns | Approximate annualized return |

| A C Choksi Share Brokers Private Limited | 1741.233 | 74.12% | 5.32% | 20.27% |

| Aarohan Holdings and Advisors Private Limited | 1375.335 | 37.53% | 2.01% | 11.19% |

| Abchlor Investment Advisors Private Limited | 1180.821 | 18.08% | 3.60% | 5.69% |

| Accuracap Consultancy Services Private Limited | 1790.573 | 79.06% | 4.76% | 21.39% |

| Acepro Advisors Private Limited | 1316.961 | 31.70% | 5.90% | 9.59% |

| Aditya Birla Money Limited | 1476.618 | 47.66% | 5.25% | 13.85% |

| Aequitas Investment Consultancy Private Limited | 2600.039 | 160.00% | 7.38% | 37.43% |

| ALANKIT ASSIGNMENTS LTD. | 1000 | 0.00% | 0.00% | 0.00% |

| ALCHEMY CAPITAL MANAGEMENT PRIVATE LTD | 1633.716 | 63.37% | 4.55% | 17.74% |

| Alder Capital Advisors LLP | 1870.584 | 87.06% | 5.02% | 23.17% |

| AlfAccurate Advisors Pvt. Ltd. | 1534.655 | 53.47% | 4.53% | 15.32% |

| ALLEGRO CAPITAL ADVISORS PVT LTD | 1309.339 | 30.93% | 2.77% | 9.38% |

| AMBIT CAPITAL PRIVATE LTD | 1416.011 | 41.60% | 3.80% | 12.27% |

| ANAND RATHI ADVISORS LIMITED | 1585.568 | 58.56% | 3.85% | 16.58% |

| ANGEL BROKING LTD. | 1605.626 | 60.56% | 4.31% | 17.06% |

| Anived Portfolio Managers Pvt. Ltd. | 1122.251 | 12.23% | 4.29% | 3.91% |

| ANVIL WEALTH MANAGEMENT PVT LTD | 1570.36 | 57.36% | 3.80% | |

| Aquamarine Investment Managers LLP | 1149.99 | 15.00% | 2.59% | 4.76% |

| Ashwani Gujral Investment & Portfolio Management Pvt. Ltd. | 1000 | 0.00% | 0.00% | 0.00% |

| Asian Markets Securities Private Limited | 1354.217 | 35.42% | 4.13% | 10.62% |

| ASK Investment Managers Private Limited | 1170.337 | 17.03% | 3.64% | 5.37% |

| ASTUTE INVESTMENT MANAGEMENT PRIVATE LIMITED | 1162.739 | 16.27% | 5.22% | 5.14% |

| ATLAS INTEGRATED FINANCE LTD | 1549.202 | 54.92% | 3.98% | 15.68% |

| Axis Asset Management Company Limited | 1122.112 | 12.21% | 3.08% | 3.91% |

| BANYAN CAPITAL ADVISORS PRIVATE LIMITED | 1354.428 | 35.44% | 3.93% | 10.62% |

| BANYAN TREE ADVISORS PRIVATE LIMITED | 1652.148 | 65.21% | 2.98% | 18.18% |

| BARCLAYS SECURITIES (INDIA) PRIVATE LIMITED | 1323.997 | 32.40% | 2.85% | 9.79% |

| Basant Maheshwari Wealth Advisers LLP | 1652.767 | 65.28% | 7.66% | 18.20% |

| BELLWETHER CAPITAL PRIVATE LIMITED | 1908.226 | 90.82% | 5.01% | 23.99% |

| BIRLA SUN LIFE ASSET MANAGEMENT COMPANY LIMITED | 1159.081 | 15.91% | 4.11% | 5.03% |

| BNP Paribas Asset Management India Private Limited | 1191.867 | 19.19% | 4.69% | 6.01% |

| BNP Paribas Investment services India Pvt Ltd | 1106.184 | 10.62% | 1.12% | 3.41% |

| BONANZA PORTFOLIO LIMITED | 2127.614 | 112.76% | 8.68% | 28.56% |

| Bullero Capital Private Limited | 1258.964 | 25.90% | 4.01% | 7.96% |

| CAPSTOCKS AND SECURITIES (INDIA) PRIVATE | 1583.827 | 58.38% | 5.09% | 16.53% |

| Care Portfolio Managers Private Limited | 1283.945 | 28.39% | 6.80% | 8.67% |

| Centrum Broking Limited | 1207.469 | 20.75% | 4.37% | 6.47% |

| CHONA FINANCIAL SERVICES PRIVATE LTD. | 1108.5 | 10.85% | 3.68% | 3.49% |

| CONCEPT SECURITIES PRIVATE LIMITED | 1580.635 | 58.06% | 4.28% | 16.45% |

| Consortium Securities Pvt. Ltd. | 2732.695 | 173.27% | 6.80% | 39.72% |

| Crest Wealth Management Private Limited | 1217.472 | 21.75% | 4.30% | 6.77% |

| Dalal & Broacha Stock Broking Pvt. Ltd. | 1480.696 | 48.07% | 4.06% | 13.95% |

| DARASHAW & COMPANY LTD | 1526.164 | 52.62% | 3.93% | 15.10% |

| DEUTSCHE INVESTMENTS INDIA PRIVATE LIMITED | 1000 | 0.00% | 0.00% | 0.00% |

| DHFL Pramerica Asset Managers Private Limited | 1380.445 | 38.04% | 3.52% | 11.32% |

| DOHA BROKERAGE AND FINANCIAL SERVICES LTD | 3725.642 | 272.56% | 1.38% | 54.90% |

| Dynamic Equities Private Limited | 1395.087 | 39.51% | 5.95% | 11.72% |

| Elite Wealth Advisors Limited | 1168.343 | 16.83% | 4.38% | 5.31% |

| ELIXIR EQUITIES PVT. LTD. | 1399.619 | 39.96% | 4.95% | 11.84% |

| Emkay Investment Managers Limited | 1412.179 | 41.22% | 3.72% | 12.17% |

| ENAM ASSET MANAGEMENT CO.PVT.LTD | 1695.712 | 69.57% | 4.91% | 19.21% |

| Envision Capital Services Pvt.Ltd. | 1167.205 | 16.72% | 4.02% | 5.28% |

| EQUITY INTELLIGENCE INDIA PVT. LTD. | 1208.962 | 20.90% | 7.52% | 6.52% |

| ESCORTS SECURITIES LIMITED | 1101.21 | 10.12% | 4.83% | 3.26% |

| Estee Advisors Pvt Ltd. | 1339.847 | 33.98% | 0.38% | 10.22% |

| Ficus Mercantile Limited | 992.7787 | -0.72% | 1.10% | -0.24% |

| Five Rivers Portfolio Managers Private Limited | 1290.704 | 29.07% | 3.90% | 8.86% |

| Florintree Advisors Private Limited | 1652.248 | 65.22% | 6.67% | 18.18% |

| Forefront Capital Management Private Limited | 1250.65 | 25.06% | 3.24% | 7.73% |

| Franklin Templeton Asset Management (India) Private Limited | 816.9771 | -18.30% | 1.20% | -6.50% |

| Geojit Financial Services Limited | 7308.318 | 630.83% | 7.39% | 93.83% |

| Ghalla Bhansali Stock Brokers Private Limited | 1549.986 | 55.00% | 5.28% | 15.70% |

| GIRIK WEALTH ADVISORS PRIVATE LIMITED | 1611.658 | 61.17% | 6.09% | 17.21% |

| GLOBE CAPITAL MARKET LTD. | 1447.593 | 44.76% | 3.79% | 13.10% |

| HARMONEY WEALTH ADVISORY SERVICES INDIA PVT LTD | 1203.003 | 20.30% | 3.85% | 6.34% |

| HDFC ASSET MANAGEMENT COMPANY LTD | 1539.609 | 53.96% | 4.17% | 15.44% |

| HEDGE EQUITIES LTD | 989.3205 | -1.07% | 2.76% | -0.36% |

| HSBC ASSET MANAGEMENT (INDIA) PVT. LTD. | 1000 | 0.00% | 0.00% | 0.00% |

| ICICI PRUDENTIAL ASSET MANAGEMENT COMPANY LTD. | 1188.882 | 18.89% | 2.61% | 5.93% |

| ICICI SECURITIES PRIMARY DEALERSHIP LTD. | 15106.55 | 1410.66% | 1.43% | 146.80% |

| IDBI CAPITAL MARKET SERVICES LTD | 17485.58 | 1648.56% | 0.38% | 159.10% |

| IDFC Asset Management Company Limited | 789.7802 | -21.02% | 5.64% | -7.55% |

| IIFL WEALTH MANAGEMENT LIMITED | 8239.19 | 723.92% | 23.34% | 101.72% |

| IMPETUS WEALTH MANAGMENT PVT LTD | 1318.667 | 31.87% | 4.22% | 9.64% |

| India Infoline Asset Management Company Limited | 6846.905 | 584.69% | 14.61% | 89.67% |

| INDIA INFOLINE LTD | 1462.438 | 46.24% | 3.24% | 13.48% |

| Indiabulls Asset Management Co. Ltd. | 15721.12 | 1472.11% | 3.97% | 150.09% |

| IndiaNivesh Investment Managers Private Limited | 1859.19 | 85.92% | 5.12% | 22.92% |

| Infinity Alternatives Investment Managers Private Limited | 2059.836 | 105.98% | 5.58% | 27.18% |

| JANAK MERCHANT SECURITIES PVT LTD | 1688.315 | 68.83% | 4.82% | 19.04% |

| JEETAY INVESTMENTS PVT LTD | 1622.946 | 62.29% | 4.63% | 17.48% |

| JM FINANCIAL ASSET MANAGEMENT LTD. | 1000 | 0.00% | 0.00% | 0.00% |

| JM FINANCIAL SERVICES LTD | 951.2422 | -4.88% | 3.40% | -1.65% |

| KARMA CAPITAL ADVISORS PVT. LTD. | 1671.878 | 67.19% | 5.50% | 18.65% |

| Karvy Capital Limited | 1347.854 | 34.79% | 0.61% | 10.44% |

| KARVY STOCK BROKING LTD. | 1397.329 | 39.73% | 4.86% | 11.77% |

| KB CAPITAL MARKETS PVT. LTD. | 1635.996 | 63.60% | 4.59% | 17.80% |

| KHANDWALA SECURITIES LTD | 1472.03 | 47.20% | 5.04% | 13.73% |

| KOTAK MAHINDRA ASSET MANAGEMENT COMPANY LTD | 121383.4 | 12038.34% | 38.09% | 393.69% |

| KOTAK SECURITIES LTD | 42773.52 | 4177.35% | 34.55% | 248.93% |

| Kumar Share Brokers Limited | 1413.012 | 41.30% | 7.35% | 12.19% |

| L&T Investment Management Limited | 1000 | 0.00% | 0.00% | 0.00% |

| Laburnum Capital Advisors Private Limited | 1650.514 | 65.05% | 3.47% | 18.14% |

| LIC MUTUAL FUND ASSET MANAGEMENT LTD | 18117.96 | 1711.80% | 1.53% | 162.18% |

| MAJORTREND CAPITAL PVT LTD | 1338.248 | 33.82% | 4.29% | 10.18% |

| MARWADI SHARES & FINANCE LTD. | 1000 | 0.00% | 0.00% | 0.00% |

| MASTER PORTFOLIO SERVICES LTD | 1914.378 | 91.44% | 5.29% | 24.12% |

| MICROSEC CAPITAL LIMITED | 1058.114 | 5.81% | 3.04% | 1.90% |

| Milestone Capital Advisors Private Limited | 1000 | 0.00% | 0.00% | 0.00% |

| MILLENNIUM FINANCE LTD. | 1176.919 | 17.69% | 2.16% | 5.57% |

| MIV INVESTMENT SERVICES PVT. LTD. | 1749.472 | 74.95% | 5.21% | 20.45% |

| Moat Financial Services Private Limited | 1084.916 | 8.49% | 4.31% | 2.75% |

| MONEYBEE SECURITIES PRIVATE LIMITED | 29794.48 | 2879.45% | 29.04% | 209.37% |

| MOTILAL OSWAL ASSET MANAGEMENT COMPANY LIMITED | 1881.221 | 88.12% | 4.24% | 23.40% |

| Motilal Oswal Wealth Management Limited | 1319.505 | 31.95% | 0.95% | 9.66% |

| Multi-Act Equity Consultancy Pvt Ltd | 1607.547 | 60.75% | 2.52% | 17.11% |

| MUNOTH FINANCIAL SERVICES LTD | 2830.681 | 183.07% | 6.62% | 41.37% |

| NEW HORIZON WEALTH MANAGEMENT PRIVATE LIMITED | 1263.962 | 26.40% | 4.58% | 8.11% |

| Nine Rivers Capital Holdings Private Limited | 1322.838 | 32.28% | 5.51% | 9.76% |

| NIRMAL BANG SECURITIES PRIVATE LIMITED | 1128.07 | 12.81% | 5.70% | 4.09% |

| NJ ADVISORY SERVICES PRIVATE LIMITED | 35603.65 | 3460.37% | 16.66% | 228.26% |

| Novastar Fund Advisors Private Limited | 1091.832 | 9.18% | 0.28% | 2.97% |

| OHM PORTFOLIO EQUI RESEARCH PVT LTD. | 1355.361 | 35.54% | 5.89% | 10.65% |

| One Thirty Capital Private Limited | 1091.229 | 9.12% | 5.25% | 2.95% |

| P.C.S SECURITIES LIMITED | 2206.653 | 120.67% | 9.27% | 30.13% |

| PARAG PARIKH FINANCIAL ADVISORY SERVICES | 1090.03 | 9.00% | 4.17% | 2.91% |

| PhillipCapital (India) Private Limited | 1225.804 | 22.58% | 3.73% | 7.01% |

| PRABHUDAS LILLADHER PVT. LTD. | 1432.522 | 43.25% | 4.88% | 12.70% |

| Prithvi Finmart Private Limited | 1126.855 | 12.69% | 5.57% | 4.05% |

| PSSG CAPITAL MANAGEMENT PRIVATE LIMITED | 1322.867 | 32.29% | 4.57% | 9.76% |

| QUANTUM ADVISORS PVT.LTD. | 1591.82 | 59.18% | 3.49% | 16.73% |

| QUEST INVESTMENT ADVISORS PVT. LTD. | 1760.358 | 76.04% | 4.40% | 20.70% |

| R. WADIWALA SECURITIES PRIVATE LIMITED | 1661.76 | 66.18% | 5.53% | 18.41% |

| RELIANCE CAPITAL ASSET MANAGEMENT LTD | 1239.195 | 23.92% | 2.57% | 7.40% |

| RELIANCE WEALTH MANAGEMENT LIMITED | 1359.292 | 35.93% | 5.09% | 10.75% |

| REVELATION PORTFOLIO MANAGEMENT PVT. LTD. | 1372.148 | 37.21% | 3.55% | 11.10% |

| Right Horizons Portfolio Management Private Limited | 1287.722 | 28.77% | 2.57% | 8.78% |

| Sameeksha Capital Private Limited | 1285.144 | 28.51% | 4.23% | 8.71% |

| SAMVITTI CAPITAL PRIVATE LIMITED | 1634.313 | 63.43% | 6.20% | 17.76% |

| SATCO CAPITAL MARKETS LTD | 955.6192 | -4.44% | 3.29% | -1.50% |

| SBI FUNDS MANAGEMENT PVT LTD | 1307.672 | 30.77% | 1.12% | 9.34% |

| Securities Investment Management Private Limited | 1496.887 | 49.69% | 4.49% | 14.36% |

| Seraphic Management & Advisory Private Limited | 1304.04 | 30.40% | 6.07% | 9.23% |

| SHADE CAPITAL PRIVATE LIMITED | 1553.504 | 55.35% | 4.32% | 15.79% |

| Shepherds Hill Financial Advisors LLP | 1483.821 | 48.38% | 5.85% | 14.03% |

| Shroff Securities Private Limited | 2046.892 | 104.69% | 4.61% | 26.91% |

| Sirius Advisors Private Limited | 2387.042 | 138.70% | 5.01% | 33.57% |

| SMC INVESTMENTS AND ADVISORS LIMITED | 1527.164 | 52.72% | 4.03% | 15.13% |

| SOLDIERS FIELD INVESTMENTS PRIVATE LIMITED | 1320.715 | 32.07% | 5.60% | 9.70% |

| STATE BANK OF INDIA | 15090.42 | 1409.04% | 1.42% | 146.71% |

| Sumedha Fiscal Services Limited | 1418.469 | 41.85% | 3.26% | 12.33% |

| SUREFIN FINANCIAL CONSULTANTS PVT. LTD | 1453.645 | 45.36% | 4.84% | 13.25% |

| SYSTEMATIX SHARES AND STOCKS (INDIA) LIMITED | 1324.381 | 32.44% | 4.87% | 9.80% |

| TAMOHARA INVESTMENT MANAGERS PRIVATE LIMITED | 1615.474 | 61.55% | 4.94% | 17.30% |

| TATA ASSET MANAGEMENT LIMITED | 1487.517 | 48.75% | 3.38% | 14.13% |

| Taurus Treasury Management Services Private Limited | 1275.079 | 27.51% | 0.63% | 8.42% |

| Trivantage Capital Managment India Private Limited | 1075.114 | 7.51% | 4.06% | 2.44% |

| Trust Investment Advisors Pvt. Ltd. | 1259.412 | 25.94% | 1.92% | 7.98% |

| TRUSTLINE HOLDING PVT. LTD. | 1937.564 | 93.76% | 4.56% | 24.62% |

| Trustline Securities Limited | 1000 | 0.00% | 0.00% | 0.00% |

| UNIFI CAPITAL PRIVATE LIMITED | 1523.156 | 52.32% | 4.57% | 15.03% |

| UTI ASSET MANAGEMENT COMPANY PVT LTD | 5262.707 | 426.27% | 4.06% | 73.77% |

| Val-Q Investment Advisory Private Limited | 1396.654 | 39.67% | 4.47% | 11.76% |

| VALUEQUEST INVESTMENT ADVISORS PVT. LTD. | 1222.717 | 22.27% | 5.61% | 6.92% |

| Ventura Securities Limited | 1038.113 | 3.81% | 5.39% | 1.25% |

| WAY2WEALTH BROKERS PRIVATE LTD. | 1471.125 | 47.11% | 5.08% | 13.71% |

| Wealth Managers (India) Private Limited | 1560.67 | 56.07% | 3.73% | 15.96% |

| ZEN WEALTH MANAGEMENT SERVICES LIMITED | 7498.864 | 649.89% | 6.07% | 95.49% |

Approximate annualized return (AAR): This corresponds to the Rs. 1000 investment made. The formula is:

Current value = 1000 x (1+ AAR)^years

REPORT OF PORTFOLIO MANAGERS – As on June 30, 2019

PMs reported for the month – 321

| Discretionary# | Non-Discretionary | Advisory* | |||

|---|---|---|---|---|---|

| No. of Clients |

144879

|

7500

|

4102

|

||

| AUM (Rs. Crore) |

|

190,519.90

|

|||

| Listed Equity |

112744.51

|

19676.10

|

|||

| Unlisted Equity |

522.00

|

129.34

|

|||

| Plain Debt |

1074011.81

|

77939.45

|

|||

| Structured Debt |

1111.74

|

578.59

|

|||

| Equity Derivative |

120.61

|

-1.20

|

|||

| Mutual Fund |

12095.52

|

12781.65

|

|||

| Others |

127679.26

|

1856.12

|

|||

| Total | 1,328,285.45 | 112,960.05 | |||

| Grand Total |

|

||||

PMS Performance

“The performance of the Portfolio Manager (PM) has not been approved or recommended by SEBI nor SEBI certifies the accuracy or adequacy of the Monthly Report. The monthly report of the PM has been prepared by the individual Portfolio Manager as required by SEBI circular on ” Monthly reporting by Portfolio Managers” dated October 08, 2010 and filed with SEBI.

The monthly report, inter-alia, contains the ‘performance of the PM during the month’. It may be noted that the relationship between the PM and the client is contractual in nature and the PM mainly provides customized service taking into consideration the need of customers, their preferences, risk profiling, suitability etc.

Further, no pooling is allowed and no units are issued as in the case Mutual fund. Therefore, the performance of one portfolio manager may not be comparable with the performance of another.”

Pros and Cons of PMS

Advantages of PMS-

- You can transfer the headache of monitoring your shares and taking decisions on those shares part to the experts.

- You get the higher returns with the help support of well-knowledgeable guys.

- The experts manage your full portfolio which will provide your portfolio hassle-free management.

- You get a piece of expert advice across instruments from debt to equity to gold and mutual funds.

There is no limit to the extent to which you can invest in a certain stock. Although, there is the limit to minimum investment and that is Rs5 lakh.

The fees of the service providers for their so-called service are negotiable.

- The experts do not follow or cram the usual investing activities like what people usually do as they invest when the market is rising or vice versa. This is not so with the PMS experts. They take wise decisions and they deeply understand or analyze the market phenomenon. They keep your requirements in their minds and accordingly invests in the segment preferred.

Disadvantages of PMS-

- The PMS requires a minimum investment of Rs5 Lakh according to the guideline s of the SEBI. This is a real drawback for small investors who cannot enjoy the services of PMS.

- It shares only the profits, and not the losses.

- The tax implication is the same as what is imposed by normal investing in shares. No tax exemption is entertained here.

- The completion of the document requirement is complex and requires more time.

- You cannot customize the portfolio as per your needs. The only thing is you may have access to more information.

How can you invest in PMS?

If you wish to invest in PMS, then you have to contact the company service provider and sign certain documents regarding your agreement with the service provider, like- submit the following documents-

- a) You have to sign a PMS agreement with the provider.

- b) You have to sign a Power of Attorney agreement.

In addition to this, you have to provide documents to judge your authority and authenticity. These are-

- PAN

- Address proof

- Identity proofs

Points to be noted-

- You have to open a Demat account, even if you already have one.

- NRIs can invest in PMS of India.

- The NRIs have to open a PIS account for investing in PMS, rather than the Demat account and the documents requirements are also different which are listed by every company.

You can invest in PMS in two ways.

- Either you can invest via cheque or

- You can transfer the shares in the shares which are already held by you in the PMS account but the value of those shares should be above the minimum investment criteria.

| Best Share Trading Apps 2025 | Best 5 Discount Brokers in India |

| How to Open Demat Account? | How to Invest in share market? |

| Best Investment Advice websites |

Working of a PMS

See, there are so many individuals in the market who are wealthy enough to entertain themselves with the services of PMS. All have different capacities for doing investments and so they are likely to make investments or pick up the PMS scheme on time variations.

These factors of investment capacity and time variation mainly make the PMS account of everybody unique in itself. Let’s again clearly mention the factors in the following bullets.

- The entry of investors at a different time.

- The difference in the number of investments by the investors

- Redemptions/additional purchase done by the investor.

- Market scenario – Eg If the model portfolio has an investment in Infosys, and the current view of the Fund Manager on Infosys is “HOLD”(and not “BUY”), a new investor may not have Infosys in his portfolio.

However, the investment is done according to the portfolio model chosen by the investor with the PMS Service provider. The customer will get the valuation of his portfolio on a daily basis from the PMS provider.

When you pick a PMS scheme, you have to first open your bank account and the demat account. The purpose of opening such accounts is to transact all the investment activities under your name only.

When you invest in any shares, then the dividend will be credited to your bank account while the shares will be credited to your demat account. In this way, the process continues.

Generally, the power of attorney to handle your bank and demat account lies with your portfolio manager. If you want to view your market status, then you can ask your manager to give your credentials to open the website and track your portfolio performance.

PMS Charges in India

We have talked about the minimum investment required by the PMS. Right? So, this investment has a percentage share of fees also for this service provider. You should see that what percentage of fees is charged by these service providers out of your total invested part.

Entry Load– Whenever you take an entry into the PMS, you are charged an entry fee which is generally termed as the Entry Load. It is 3% or it may vary.

Management Charges– This is a service charge for managing your portfolio. It may vary from 1-3%, depending upon the service provider. It is charged on a quarterly basis.

Profit Sharing Fees– If a PMS has profit-sharing agreements between the client and provider, in addition to other fixed fees, then this charge is based on such terms of an agreement.

Apart from the charges mentioned above, the PMS also charges the investors on the following counts as all the investments are done in the name of the investor:

- Custodian Fee

- Demat Account opening charges

- Audit charges

- Transaction brokerage

Should we go for PMS or Portfolio Management Service?

Considering the absence of strict regulations (like Mutual Funds), I feel it is a grey area of investment. Hence, I skip PMS mainly because of the below reasons.

# Expenses:- When you compare PMS expenses with Mutual Funds, then PMS expenses are really heavy. When Index Funds are available at damn cheap expenses of around 0.1% to 0.4%, why we have to pay hefty charges?

# Returns:-As I pointed from the above post that return reporting is a big flaw when it comes to PMS. I am not saying all are wrong, but I am completely agree with SEBI report. Hence, on which basis one can trust and go ahead?

# Ticket Size-The current minimum ticket size is Rs.25 lakh. However, in the same report, it was recommended to increase it to Rs.50 lakh. Hence, it is not a product for individuals whose net worth runs in crores.

# Taxation-This is one more negative point to distance. Even though we are investing in equity, the taxation of Mutual Funds is far simpler than the PMS. Also, due to taxation, it will affect our compounding returns. Hence, a big drawback for PMS.

# Documentation-Since PMS accounts entail the opening of a segregated Demat account and registering a power of attorney in favor of the portfolio manager, the documentation tends to be

onerous as compared to Mutual Funds.

# Regulations-Personally I feel, there need to be stricter regulations and disclosure norms for PMS. This is currently lagging. Hence, I don’t want my money to be BAKRAA.

My idea of writing this post is not to give you “PMS Returns 2020 – Who is the best PMS in India?”, but the idea of sharing you the risk involved in if you chase the RETURNS and choose the BEST PMS in India.

Taxation on PMS

If the capital gains have been acquired by selling the equity-oriented securities on recognized stock exchanges, then tax will be charged as follows-

- a) The long-term capital gains are exempted from taxes.

- b) Short-term capital gain is taxed @15% flat.

If the equities are not sold on the recognized stock exchanges then-

- a) Long-term capital gain is charged to tax at the flat rate of 20% after applying the cost inflation index.

- b) Short-term capital gain on the above assets has to be aggregated with the investor’s other income and is taxable at the slab rates applicable to him.

Difference Between PMS and Mutual Fund

In mutual funds, your money was pooled into the money of other investors and you gain only the units in the fund. In the PMS, you directly own the shares of the company.

There is a wide variety of portfolio managers in PMS as compared to mutual funds. But it restricts the investor to detail out the information of the prospective manager regarding his past performance, past organizational structure, key personnel, etc., because these managers have to present them a document called a disclosure document.

But there is no central place for these managers which can be referenced by the customers to analyze their performances and compare them and do a final selection.

The charges for mutual fund management experts are literally very minimum, but the cost of PMS is very high and can be afforded by only wealthy individuals.

We cannot manipulate your mind for the selection of mutual funds or the PMS as they both are significant in their own levels. While mutual funds are suitable for every personality group, PMS demands a higher class of people to do investment.

But if you are among those who are interested to deal with the PMS, then don’t forget to analyze fully about various PMS available in the market. After all, you are going to invest a large lump sum amount into the Best performing PMS in India and it is not a joke. Right?

So, all the best for your investments.

Just share your experiences with us. You can also tell us your doubts and mention your suggestions too by commenting on the comment box.

Don’t forget to like and subscribe to us and stay tuned always with us.

Thank you and keep investing.

Bye.

MOTILAL OSWAL ASSET MANAGEMENT COMPANY LIMITED

UTI ASSET MANAGEMENT COMPANY PVT LTD

BANYAN TREE ADVISORS PRIVATE LIMITED

STATE BANK OF INDIA

LIC MUTUAL FUND ASSET MANAGEMENT LTD

ICICI SECURITIES PRIMARY DEALERSHIP LTD.

DOHA BROKERAGE AND FINANCIAL SERVICES LTD

IDBI CAPITAL MARKET SERVICES LTD

I would not recommend it. There are many cases of T.V analysts who run portfolio management services – and people have lost 50% or more of their capital with them… Trading and investing is a difficult business, was it easy, Tata’s, Birla’s and Ambani’s and would stop investing thousand of crores in uncertain business, and make a potful of money investing with Portfolio Service Managers.

Thank you for this informative post. According to me Motilal Oswal offers best Portfolio Management Service in India.

Kotak has worst PMS team and their PMS product is pathetic. On top of it, they always don’t have any clear way forward or justification for the pathetic performance of product. My capital value has left only 50 % since almost 3 years now. They are just prompt in deducting their charges from the account. They are good for nothing. The fund manager has some theoretical statements to read whenever you call them to ask whats future strategy. I would not recommend Kotak PMS/Kotak Bank in any case for any kind of investment if you want to secure your hard earned Capital.

ICICI Prudential claims as the best PMS service provider however my investment ruined by 40% in last 3 years. On top of that they charge heavy fees irrespective of whether your portfolio is 40% or 50% in loss. Do they charge for making loss?? Any investor by simply investing in current blue chip stock would have made at least 4-5% in last 3 years against bench mark. Their standard reply is we have a long term strategy and you have to wait. So you keep waiting till all your money is exhausted. Pathetic, have no other words. Don’t get fooled by investing your money to feed so called high profile portfolio managers.

It is not shockingly true that any donkey trading long would have made so much profit in the last 6 or 9 months since the fall down in March 2020 amid COVID-19 pandemic. So I would be deciding the best performer based on their performance during narrow market period. Sure there won’t be any. If you are getting around 13-20% per annum, after deducting all the charges, that it would be great.