Affle India IPO Review, Dates, Price Bands and Market Lot

IPO stands for Initial public offering. In the year 2019, many companies made a stellar debut on a stock exchange.

The exciting news for the investors is Affle India Ltd. has received approval from the market regulator SEBI to float its Rs 459 crore IPO.

AFFLE (INDIA) LTD is a global technology business. It has two business segments: One is Consumer Platform; second is Enterprise Platform.

Stay tuned in the end to learn about “Affle India IPO details. So, without any further delay let’s get started

About Affle India LTD.

Affle India is End-to-End Platform to Grow Marketing ROI – Enhance Marketing ROI and drive Consumer Acquisitions, Engagements & Transactions

Affle India is End-to-End Platform to Grow Marketing ROI – Enhance Marketing ROI and drive Consumer Acquisitions, Engagements & Transactions

Its Consumer Platform primarily provides the services like New consumer conversions (acquisitions, engagements, and transactions) through relevant mobile advertising; Retargeting existing consumers to complete transactions for e-commerce companies through relevant mobile advertising, and An online to offline (“O2O”) platform that converts online consumer engagement into in-store walk-ins.

AFFLE (INDIA) LTD is a global technology business. It has two business segments: One is Consumer Platform;

second is Enterprise Platform.

» Its Consumer Platform primarily provides the following services:

✴ New consumer conversions (acquisitions, engagements, and transactions) through relevant mobile advertising;

✴ Retargeting existing consumers to complete transactions for e-commerce companies through relevant mobile

advertising; and

✴ An online to offline (“O2O”) platform that converts online consumer engagement into in-store walk-ins.

» Its Consumer Platform is used by business to consumer (“B2C”) companies across industries, including e-commerce,

fin-tech, telecom, media, retail and FMCG companies, both directly and indirectly through their advertising agencies.

It aims to enhance returns on marketing spend through delivering contextual mobile ads and reducing digital ad

fraud, while proactively addressing consumer privacy expectations.

Affle India Limited IPO – Issue Details:

| Issuer | Affle India Limited (View Report) | |

| Issue Type | 100% Book Built Issue IPO | |

| Issue Period | Issue Opens: Jul 29, 2019 | |

| Issue Closes: Jul 31, 2019 | ||

| Price Brand | Rs.740* – Rs.745^ per Equity Share | |

| Issue Size | Rs.457* Crores – Rs.459^ Crores | |

| Face Value | Rs.10 per Equity Share | |

| Bit Lot | 20 Equity Shares and in multiples thereof | |

| Maximum Bid amount for Retail | Rs. 2 Lakhs | |

| Institutional | 75% of the issue size (46,26,927* – 46,20,805^ Equity Shares) | |

| Corporate | 15% of the issue size (9,25,385* – 9,24,161^ Equity Shares) | |

| Retail Individual Bidders | 10% of the issue size (6,16,924* – 6,16,107^ Equity Shares) | |

| Listing | NSE & BSE | |

| UPI | All Retail Applications compulsorily in UPI Mode | |

| Registrar | Karvy Fintech Pvt Limited | |

| Book Running Lead Managers | ICICI Securities & Nomura Financial | |

| Upcoming IPO 2019 | Upcoming NCD 2019 |

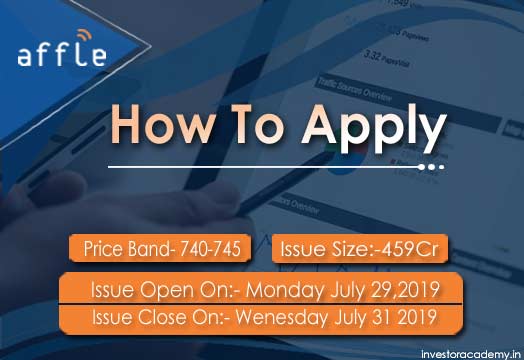

Affle India IPO Dates & Price Band

The face value of each share is Rs 10, but the price band of the IPO is not yet revealed

- IPO Open: Monday, 29th July, 2019

- IPO Close: Wednesday, 31st Jul, 2019

- IPO Size: Rs. 457 Cr* – 459 Cr^

- Face Value: Rs. 10

- Price Band: Rs. 740* – Rs. 745^ per Equity Share

- Listing on: BSE & NSE

- Retail Portion: 10%

- Equity: No. Shares

- Tips for Investing in Affle India IPO

Affle India IPO Market Lot

- Shares: Apply for 20 Shares (Minimum Lot Size)

- Amount: ₹14,900/—

Affle India IPO Allotment & Listing

- Bid/Offer Opens On : Jul 29, 2019

- Bid/Offer Closes On : Jul 31, 2019

- The basis of Allotment: Aug 5, 2019

- Refunds: Aug 6, 2019

- Credit to demat accounts: Aug 7, 2019

- Affle IPO Listing date: Aug 8, 2019

The shares subscribed by the public will be updated here.

Affle Limited IPO Review & Ratings

| IPO Ratings & Review | |

| Criteria | Ratings |

| Industry Sentiments | 7.8/10 |

| Industry Ranking | 8.7/10 |

| Company Background | 7.9/10 |

| Company Reputation | 8.6/10 |

| Competitive Edge | 7.7/10 |

| Financial Statements | 7.8/10 |

| Popularity Index | 8.7/10 |

| Promoters Reputation | 7.7/10 |

| Retail Appetite | 7.9/10 |

| Top Brokers Review | 7.9/10 |

| Overall Ratings | 7.9/10 |

| Star Ratings | ★★★★☆ |

Affle Limited IPO Review by Stock Brokers

| Brokers Review | Company Reputation | Competitive Edge | Financial Statement | Popularity Index | Promoters Reputation |

| Angel Broking | 7.7/10 | 7.7/10 | 7.8/10 | 7.3/10 | 7.7/10 |

| Sharekhan | 7.4/10 | 7.4/10 | 7.5/10 | 7.7/10 | 7.8/10 |

| Kotak Securities | 7.7/10 | 7.4/10 | 7.3/10 | 7.8/10 | 7.5/10 |

| ICICI Direct | 7.8/10 | 7.7/10 | 7.5/10 | 7.5/10 | 7.7/10 |

| IIFL | 7.5/10 | 7.8/10 | 7.3/10 | 7.7/10 | 7.5/10 |

| Edelweiss | 7.3/10 | 7.5/10 | 7.7/10 | 7.3/10 | 7.3/10 |

| Zerodha | 7.7/10 | 7.3/10 | 7.7/10 | 7.5/10 | 7.7/10 |

| 5Paisa | 7.9/10 | 7.5/10 | 7.8/10 | 7.3/10 | 7.3/10 |

| Karvy | 7.7/10 | 7.3/10 | 7.5/10 | 7.5/10 | 7.7/10 |

| Motilal Oswal | 7.9/10 | 7.7/10 | 7.3/10 | 7.3/10 | 7.7/10 |

The ratings would be updated once the financials and the other details of the IPO are released.

Affle Limited IPO Grey Market Premium

The Affle Limited IPO Grey Market Premium price is Rs 160-165, the Kostak rate is Rs 250 and the Subject to Sauda is Rs 2000.

How to Apply for Affle India IPO?

Investors should note that the Offered Shares will be Allotted to all successful Bidders only in dematerialized form. The Bid cum Application Forms which do not have the details of the Bidders depository accounts, including DP ID, Client ID, and PAN and UPI ID (for RII Bidders bidding using the UPI mechanism), shall be treated as incomplete and rejected. Bidders will not have the option of being Allotted Equity Shares in physical form.

RIIs Bidding through the Designated Intermediaries can only Bid using the UPI mechanism.

RIIs bidding using the UPI mechanism must provide the UPI ID in the relevant space provided in the Bid cum Application Form and the Bid cum Application Form that does not contain the UPI ID are liable to be rejected.

Applications made by the RIIs using a third party bank account or using the third-party linked bank account UPI ID are liable for rejection.

RIIs submitting a Bid-cum Application Form to any Designated Intermediary (other than SCSBs) should ensure that only the UPI ID is mentioned in the Field Number 7 i.e. Payment Details in the Bid cum Application Form.

ASBA Forms submitted by RIIs to Designated Intermediary (other than SCSBs) with ASBA Account details in Field Number 7 are liable to be rejected.

| Best Apps to Invest in Mutual Funds | Best Stock Trading Apps 2019 |

| Best Sites for Indian Stock Market | Best Books for Share Market |

Financial Summary of Affle India Limited (Unconsolidated)

Financial Summary:

| Amount (in INR Millions) | ||||

| 31-Mar-19 | 31-Mar-18 | 31-Mar-17 | 31-Mar-16 | |

| Total Assets | 935.85 | 580.31 | 486.89 | 539.05 |

| *Total Revenue | 1,214.45 | 848.78 | 668 | 888.51 |

| Total Expense | 979.03 | 712.82 | 8.00 | 849.92 |

| Profit After Tax | 166.79 | 88.31 | 3.30 | 23.94 |

Earnings per Equity Share (INR Millions)

| 31-Dec-19 | 31-Dec-18 | 31-Mar-17 | 31-Mar-16 | |

| Basic | 6.87 | 3.64 | 0.14 | 0.99 |

| Diluted | 6.87 | 3.64 | 0.14 | 0.99 |

Affle India IPO – Promoters

The Promoter of this company are:

- Anuj Khanna Sohum and

- Affle Holdings

Key Strengths:

» Its Consumer Platform has a leading position in India; a high growth market with substantial barriers to entry.

» Proven international track record

» Profitable, low-cost business model built on an asset-light, automated and scalable platform

» Growth driven, global customer base

» Addressing digital fraud and data safety issues that are prevalent in the industry

» Its Vizury Commerce Business and RevX Platform expand its engagement with e-commerce companies to include retargeting services and its Vizury Commerce. Business expands its reach in the Middle East and Africa

» Experienced and dedicated Key Management Personnel, who are ably supported by its other employees.

Key Strategies:

» Enhance its Affle Consumer Platform’s revenue from existing and new customers in India and acquire new consumer profiles beyond Tier 1 cities.

» Expand its international business through local business development efforts and through referrals from its existing customers.

» Drive further penetration in its top customers and deliver more converted users for large e-commerce companies

» Continue to invest in and develop its technological capabilities

» Continue to develop its award-winning fraudulent data detection and prevention platform

» Continue to selectively pursue acquisitions

» Cross-sell its solutions.

Affle India Limited IPO Lead Managers

| Lead Managers |

| ICICI Securities LimitedNomura Financial Advisory and Securities (India) Private Limited |

Affle Limited IPO Registrar to the Offer

| Registrar to the Offer |

| Karvy Computershare Private Limited Karvy Selenium Tower B Plot 31-32, Gachibowli Financial District, Nanakramguda Hyderabad 500 032, India Tel: +91 40 6716 2222, Fax: +91 40 2343 1551 E-mail: einward.ris@karvy.com Investor Grievance E-mail: affletechnology.ipo@karvy.com Website: https://karisma.karvy.com Contact Person: Murali Krishna SEBI Registration No.: INR000000221 |

Valuation of Affle India (FY2019 consolidated)

- Earnings Per Share (EPS): INR20.10

- Price/Earnings (PE ratio): 36.81 – 37.06

- Return on Net Worth (RONW): 67.4%

- Net Asset Value (NAV): INR29.81 per share

Affle India Contact Details

Affe India Limited

601-612, 6th Floor, Tower C

JMD Megapolis, Sohna Road

Sector 48, Gurgaon 122 018

Phone: +91 124 4992 914

Email: compliance@affle.com

Website: www.affle.com

Dear Readers

Hope you find useful information about “Affle India IPO”.

If you have any query regarding this post feel free to comment below.

| Best Discount Broker in India? | How to Invest in Share Market? |

| Mutual Funds Basics | What is a Fixed Deposit? |