Zerodha Review 2020 | Zero dha Brokerage Charges, Margin, Demat Account

“Zerodha” is a brokerage firm aims to provide broking services to its customers to operate in the stock market. It is the most leading firm in India and counted at first when it comes to selecting any discount broking services.

Discount broking services are those kinds of services in which the facilities for trading platforms are facilitated to the customers so that they can trade in the stock market on various securities. But it does not provide advisory services to them.

So, Zerodha is a discount-broking service provider and it avails all the services at a very reasonable cost. You can say that it takes part in the customer’s responsibility on their shoulders.

Zerodha Review 2020

The Zero dha was established in the year 2010 and it has completed its 7 years in the brokerage business. It has the largest volume trade in India and so it has the largest customer base too. It would not be considered wrong to say that it is a pioneer of discount broking model in India.

It sounds good to inform you that Zerodha broker avails 10,000 Crore rupees turnover on a daily basis, as it is doing an outstanding job on the platforms of NSE, BSE, MCX, and MCX-SX. There are many securities that can be chosen by you to trade in the stock market as you can deal in equities, derivatives, and currencies. For equity transactions, it does not charge any service fees, but for other security transactions, it charges Rs 20 or 0.1% of the turnover, whichever is lower.

In short, it provides you the following services-

- Opens Demat account and trading account

- Maintains a Demat and trading account.

- Trading platforms like the BSE, NSE, MCX, MSX-SX.

- It provides a fund transfer facility.

- Transfer of shares services.

- Open Free Zerodha Account

Zerodha Trading Tutorial in Hindi for Beginners

In this article, you will learn about-

- Zerodha’s product and services Review

- Zerodha Brokerage charges

- Zerodha Account opening process

- Zerodha Close competitors

- Zerodha Account opening charges

- Zerodha kite

- Zerodha margin

- Zerodha Brokerage calculator

- Zerodha Pros and cons

- How to open Zerodha accounts?

- Zerodha customer care / Helpline

Now, let’s take the first step towards learning the Demat account and the trading account.

Demat account is needed when you wish to enter the stock market for the first time or you do not have an account. It is the license in the stock market to allow you to trade in the market. Whatever shares you purchase, they are kept in the Demat account. Actually, the balance of shares is kept, which means that after selling shares from a number of availed shares (purchased already), the balanced left is kept in this account.

The trading account is another account, which is opened after a Demat account. Whatever trading of shares you need to do for doing business in the stock share market, you would need this particular account.

So dear readers, the opening of these two accounts needs maintenance also and both these services for opening and maintaining are provided by the Zerodha brokerage firm. They charge some fees also. Let’s see the fee structure in the following bullets.

Zerodha Brokerage Charges

- Trading Account Opening Charges (One Time): Rs 300

- Demat account Opening Charges (One Time): Rs 100

- Trading Annual maintenance charges (AMC): Rs 0

- Demat Account Annual Maintenance Charges (AMC): Rs 300 per year (payable upfront)

- Check complete pricing list here https://zerodha.com/pricing

Other charges-

As we already mentioned to you that Zerodha provides you trading exchange platforms for doing buying and selling of securities there, so here we have brought a table for you in which you will see the charges charged by the firm for availing its services. But before that, it will be better to understand some terms which you will encounter in the table.

- STT– it is the transaction cost that is charged on each buying and selling transaction of shares on trade exchanges. It is fully abbreviated as the Security Transactions Tax. It is charged only on the selling side when trading intraday or on F&O.

- Transaction cost– on each transaction, whether it is buying shares or selling shares, the cost of service incurred on it is called as the transaction cost. Exchange transaction charges + Clearing charges is the total charge.

- GST-Tax levied by the government on the services rendered. 18% of ( brokerage + transaction charges) are levied.

- SEBI charges– the charges on the fees collected from the investors to trade on stock exchanges and from the brokerage house by the SEBI is the SEBI charge. It is charged at 15% of the total turnover.

Zerodha Charges for Equity Segment

| ZERODHA CHARGES | EQUITY DELIVERY | EQUITY INTRADAY | EQUITY FUTURES | EQUITY OPTIONS |

|---|---|---|---|---|

| BROKERAGE | Zero Brokerage | 0.01% or Rs. 20/executed order whichever is lower | 0.01% or Rs. 20/executed order whichever is lower | Flat Rs. 20 per executed order |

| STT/CTT | 0.1% on buy & sell | 0.025% on the sell-side | 0.01% on sell-side | 0.05% on sell-side (on premium) |

| TRANSACTION CHARGES | NSE: 0.00325% BSE: 0.003% |

NSE: 0.00325% BSE: 0.003% |

NSE: Exchange txn charge: 0.0019% |

NSE: Exchange txn charge: 0.05% (on premium) |

| GST | 18% on (Brokerage + transaction charges) | 18% on (Brokerage + transaction charges) | 18% on (Brokerage + transaction charges) | 18% on (Brokerage + transaction charges) |

| SEBI CHARGES | ₹10 / crore | ₹10 / crore | ₹10 / crore | ₹10 / crore |

Zerodha Charges for Commodity Segment

| ZERODHA CHARGES | COMMODITY FUTURES | COMMODITY OPTIONS |

|---|---|---|

| BROKERAGE | 0.01% or Rs. 20/executed order whichever is lower | 0.01% or Rs. 20/executed order whichever is lower |

| STT/CTT | 0.01% on sell-side (Non-Agri) | 0.05% on sell-side |

| TRANSACTION CHARGES | Group A Exchange txn charge: 0.0026% * Far-month contracts: 0.0013% Group B: Exchange txn charge: CASTOR SEED – 0.0005% KAPAS – 0.0005% PEPPER – 0.00005% RBDPMOLEIN – 0.001% |

Exchange txn charge: 0 |

| GST | 18% on (Brokerage + transaction charges) | 18% on (Brokerage + transaction charges) |

| SEBI CHARGES | Agri: ₹1 / crore Non-Agri: ₹10 / crore |

₹10 / crore |

Zerodha Charges for Currency Segment

| ZERODHA CHARGES | CURRENCY FUTURES | CURRENCY OPTIONS |

|---|---|---|

| BROKERAGE | 0.01% or Rs. 20/executed order whichever is lower | 0.01% or Rs. 20/executed order whichever is lower |

| STT/CTT | No STT | No STT |

| TRANSACTION CHARGES | NSE: Exchange txn charge: 0.0009% BSE: Exchange txn charge: 0.00022% |

NSE: Exchange txn charge: 0.0007% BSE: Exchange txn charge: 0.001% |

| GST | 18% on (Brokerage + transaction charges) | 18% on (Brokerage + transaction charges) |

| SEBI CHARGES | ₹10 / crore | ₹10 / crore |

| How to Invest in Share Market? | How to trade in stock market? |

| Best Investment Options In India | Best Saving Bank Accounts |

Zerodha Trading Platforms

There are many online trading platforms in the form of websites and mobile applications that are framed to provide easy access to customers from every corner of the country. Those who don’t have mobile can use laptops or tablets or personal computers to reach the websites, otherwise Mobile is able to reach anywhere. Some of the trading platforms are discussed below-

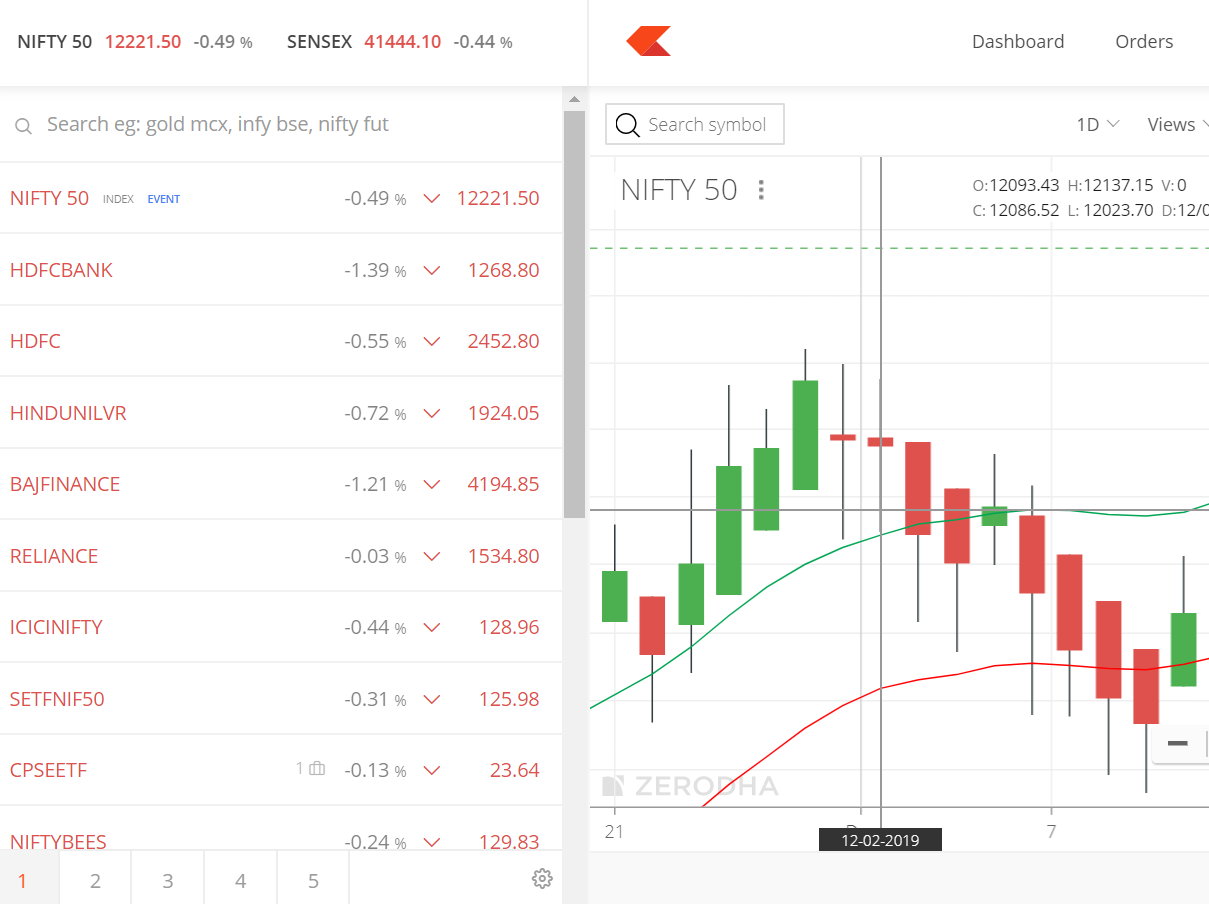

Zerodha Kite

It is a Zerodha website (https://zerodha.com/) which was established in the year 2015. It can be used through mobile, tablets and through any browser. Whatever language you understand, you can trade in that language and can understand the things on the screen in that language only and this quality makes this platform a unique attraction. It has a total of 10 languages installed in it. So, if you are not comfortable in the English language, then chose another one. Simple, isn’t it?

It provides extensive charting facilities to understand the deep analysis on the stocks market with more than 100 different indicators and 6 different chart types. Not only this, this web consumes very less bandwidth of less than 0.5kbps for a full MarketWatch, so you can access them very speedily.

“Kite” is a sleek investment and trading platform built for modern times and sensibilities. Groundbreaking innovations presented with excellent usability, investing in the stock markets has never been this easy. Really.

- Universal instrument search – Search across 90,000+ stocks and F&O contracts across multiple exchanges instantly. Find your favorite stocks, bonds, metals, or derivatives, anything really, with absolutely zero latency.

- Sleek User Interface – With a sleek and carefully designed UI, buying, selling, analyzing, and managing your portfolio, everything’s just a click away. Navigate the app seamlessly with intuitively designed keyboard shortcuts.

- 20 market depth or level 3 data– Exclusive access to level 3 data, or 20 market depth. Level 3 data gives you deeper insights into market liquidity and allows you to develop sophisticated intraday trading strategies.

- Advanced charting – Hundreds of indicators, studies, and tools on a powerful and customizable charting interface. Extensive historical data for stocks and F&O contracts. Nobody else offers as much data as we do.

- GTT – Good Till Triggered orders – Place single-leg triggers to enter or exit stock holdings until your price condition is met, along with simultaneously placing target and stop-loss (OCO or One Cancels Other) for your stock holdings.

| Best Stock Trading Apps 2020 | Best Books for Stock Market |

| Best Sites for Share Market | Best Mutual Funds Apps 2020 |

Apply for IPOs online through Zerodha

You can now apply for New IPOs (Initial Public Offerings) from within Console. You can use any UPI 2.0 enabled app to apply for an IPO through Zerodha. Install any UPI 2.0 enabled app and follow the below steps to apply for an IPO through Zerodha. Check How to Create BHIM UPI ID?

- Check Step by Step Guide – How to apply IPO through Zerodha?

| How to Apply IPO through ASBA? | IPO Grey Market Price |

| IPO Investing Tips & Tricks | Intraday Trading Basics |

Zerodha Trader

It is an app that can be downloaded on your computer and mobiles. It provides you the real-time marketing features with speedy connections and with everything which is needed to execute any trading. This is available at free of cost.

Zerodha Mobile. The website is available in the form of the app also which will ease your trading operation on some finger clicks only.

Zerodha Coin

Zerodha Coin is India’s largest direct mutual fund platform that lets you buy direct mutual funds online with no commission passback, directly from asset management companies. Your mutual funds, stocks, currencies, bonds, and more, all in your Demat account.

Zerodha Console

The central dashboard for your Zerodha account with in-depth reporting and analytics on your trades and investments. Multi-dimensional insights on your trades and portfolio presented as easy-to-understand visualizations.

Complete history breaks down of your stocks by the trade from the day of acquisition. Understand your trades better with per-trade charge breakdowns showing brokerage, STT etc.

Zerodha Pi

It is a desktop trading application that lets you facilitated charting, research analysis reports on various topics, algos, strategies and much more. It has 18 different indicators on charts and 10 chart types. Using this software, traders can view up to 50,000 candles based on their system speed and configuration. They have inbuilt strategies and quick order entry screens so you can create your own strategies, backtest them and trade directly from the chart.

Zerodha Sentinel

Create powerful market alerts on the cloud for stocks, futures and options, and more for free. Alerts reside on the cloud waiting to be triggered—today, tomorrow, or months from now, even when you’re away. Get notifications on Kite web, mobile, and e-mail.

20+ data points to set alerts on—last traded price, OHLC, bids, and offers, and more. Set alerts on 80,000 stocks, bonds, commodities, derivatives, and more across exchanges

Zerodha Call and Trade Service

The calling on phone service is also availed by the Zerodha team for those who cannot trade via mobiles and websites. For this, they have to bear Rs20 per trade execution.

How to open an account with Zerodha?

Now, there are two ways to open a Demat and trading account at Zerodha:

Zerodha Account Open Methods

- Online method

- Offline method

Using the online method, you can open your account with Zerodha within 15 minutes, if you have all the required documents.

Documents required to open a Demat and trading account at Zerodha

Here are the documents required to open a Demat and trading account at Zerodha. I will recommend keeping soft copies of all these documents ready before you apply for opening the accounts as you’ve to upload them during the account opening process:

- PAN CARD

- Aadhar Card

- Canceled cheque/ Bank statement

- Your Signature on a piece of paper

- Passport size photos

For opening an account of yours, you have to fill a Zerodha online application form.

- You have to visit the https://zerodha.com/open-account website and fill the form from there. You will be asked your name, e-mail, phone, city, and state.

- After that, you have to click on the submit button.

- After that, you have to set your login password o that you can continue your application anytime.

- Click on the continue button to proceed with the process.

- In the next step, enter your PAN card number along with your date of birth.

- The final step will ask you to do the payment which will depend upon the account type you looked for Zerodha.

- After doing the payment, the next window will ask your bank details and your personal details, after filling which you have to click the ‘Continue’ button.

- In the next section, you have to link your application form with your own Aadhar card. For that, you have to enter your Aadhar Number.

- Upload your bank proof, income proof, and you have o sign-in into your e-mail ID to prove your identity.

- You will be provided an OTP for that at your e-mail which you have to enter on the form screen.

- After his, your account will be verified, passing which the process for application form will get complete.

- As a final step, you have to download and print the Demat POA document and sign it manually.

- These documents should be submitted by you at your nearby Zerodha Office.

Account opening charges at Zerodha

Here are the account opening charges at Zerodha

- Zerodha Demat and Trading Account: Rs 200

- Zerodha Commodity Account: Rs 100

(Note: This is the Revised account opening charges updated in December 2019 by Zerodha)

If you want to trade in both equity and commodity, then you need to pay an account opening charge of Rs 200+Rs 100 = Rs 300. However, if you want to trade just in equity (stocks), then you need to pay the charge of Rs 200 only.

Besides, if you face any difficulties while opening an account online, you could contact Zerodha Customer care at 080 4913 2020.

Zerodha Reviews and Rating:

After using the Zerodha, customers have the following reviews on zerodha about its services-

The SMS services of Zerodha are felt as fraud messages to investors. they are not happy with the account opening services.

The Kite app and the website platform give them a very user-friendly environment and they are happy to trade through it.

Keeping in mind the reviews from so many views, we have to give a review on Zerodha an average rating, which is designed as below-

| Overall Rating | 4.0/5 |

| Fees | 3.9/5 |

| Brokerage | 4.5/5 |

| Usability | 3.8/5 |

| Customer Service | 3.8/5 |

Zerodha Vs Competitors

Here we are comparing Zerodha with its 5 close competitors, who are currently the market leaders in the brokerage industry.

| Broker | Zerodha | Sharekhan | 5paisa | Upstox | SAMCO |

| Service Type | Discount Broker | Full Service Broker | Discount Broker | Discount Broker | Discount Broker |

| Brokerage Range | Rs 20 | 0.1 to 0.5% | Rs 20 | Rs 20 | Rs 20 |

| Account Type | 2 in 1 | 2 in 1 | 2 in 1 | 2 in 1 | 2 in 1 |

| Equity Delivery | Free | 0.5% or 50 paisa | Flat Fee Rs 20 | Free | 0.2% or Rs 20 whichever is lower |

| Equity Intraday | 0.01% or Rs 20 whichever is lower | 0.1% or 10 paisa | Flat Fee Rs 20 | 0.01% or Rs 20 whichever is lower | 0.02% or Rs 20 whichever is lower |

| Equity Futures | 0.01% or Rs 20 whichever is lower | 0.1% or 10 paisa | Flat Fee Rs 20 | Flat Fee Rs 20 | 0.02% or Rs 20 whichever is lower |

| Equity Options | Flat Fee Rs 20 | 2.5% of Premium or Rs 250 per lot whichever is high | Flat Fee Rs 20 | Flat Fee Rs 20 | Flat Fee Rs 20 |

| Commodity | Flat Fee Rs 20 | 0.1% or 10 paisa | Flat Fee Rs 20 | Flat Fee Rs 20 | Flat Fee Rs 20 |

| Currency Futures | 0.01% or Rs 20 whichever is lower | 0.1% or 10 paisa | Flat Fee Rs 20 | Flat Fee Rs 20 | 0.02% or Rs 20 whichever is lower |

| Currency Options | Flat Fee Rs 20 | 2.5% of Premium or Rs 30 per lot whichever is high | Flat Fee Rs 20 | Flat Fee Rs 20 | Flat Fee Rs 20 |

| Rating |

Zerodha Trading Platform Comparision

Here we are comparing Zerodha with its 5 close competitors on the Trading Platform.

| Broker | Zerodha | Sharekhan | 5paisa | Upstox | SAMCO |

| Desktop Windows | Yes | Yes | Yes | Yes | Yes |

| Desktop Mac | No | No | No | No | No |

| Web Trading | Yes | Yes | Yes | Yes | Yes |

| Android Tablet App | Yes | Yes | Yes | Yes | Yes |

| Android Mobile App | Yes | Yes | Yes | Yes | Yes |

| iPhone App (iOS Mobile App) | Yes | Yes | Yes | Yes | No |

| iPad App | Yes | Yes | Yes | Yes | No |

| Mobile Site | Yes | Yes | Yes | Yes | Yes |

Advantages of Zerodha

- All the equity delivery trades services are freely available.

- All services by Zerodha are provided at cheaper rates as compared to other discount brokerage houses.

- You not at all have to pay the charges for Trading account AMC.

- The ‘Algos’ tool of Zerodha allows you to form codes for technical strategies. This is available at free of cost.

- It also gives facility for Mutual Funds, unlike other discount brokerage firms.

- Zerodha’s daily turnover is 7000Crore rupees.

- A fund transfer facility is available online.

- Good Till Cancelled (GTC) and Good Till Date/Time (GTD) Orders are available for both Commodity & Equity segment.

Disadvantages of Zerodha

- 3-in-1 account, i.e. the Demat account, Trading account, and the savings account opening services are not available in combination.

- It does not provide advisory services.

- Zerodha doesn’t provide margin funding to its customers. It allows you to trade only when you have enough money in your trading account.

- Zerodha doesn’t offer trading in currency derivatives at BSE.

Zerodha Customer Care

Zerodha Helpline Numbers

- Zerodha New Account opening (9:00 AM – 6:00 PM)

080 4913 2020 / 080 6666 2020 - Zerodha Support Contact Numbers (8:30 AM – 6:00 PM)

080 4040 2020 / 080 6620 2020 - Zerodha Call & trade (9:00 AM – 12:00 AM)

080 4040 2020 / 080 6620 2020

Zerodha HQ

Zerodha, #153/154,

4th Cross, J.P Nagar 4th Phase,

Opp. Clarence Public School,

Bengaluru – 560078

Zerodha Sales

Zerodha, #175/176, 2nd Floor,

Next to Rainbow Hospital,

Bannergatta Road, Bilekahalli,

Bengaluru – 560076

A final thought about the company-

As Zerodha is the oldest firm I discount brokerages firm, it has continuously performed at its best level. It provides very cheap cost facilities that are much satisfactory too. the plus points and negative points are displayed right before you.

No doubt, customers still face some kind of hurdles from Zerodha, but don’t mean that Zerodha has poor customer service. With time, it has always improved its service. So, there is no fear to deal with Zerodha.

After reading this article, if you have any doubts left in your mind, then please let us know by commenting in the comment box.

Please like and subscribe to us if you love to hear us.

Thank for reading us.

Latest Updates On Zerodha

There are two major regulatory changes from Sep 1st, 2020:

- The method of pledging stocks, and

- Upfront margin requirements (Stocks and F&O on NSE, BSE, MCX)

New pledging system

Until now, when you pledged stocks as collateral to receive margins for trading F&O, you had to move it from your Demat account to the broker and in turn to the clearing corporation. Going forward, the stock will continue to remain in your Demat account and can be directly pledged to the clearing corporation. Over the last weekend, we have unpledged all securities which were pledged with us and transferred back to the customer Demat account. Many have already repledged it using the new mechanism. Check this article on how the new pledging mechanism works.

New margins system

There are going to be a bunch of changes from tomorrow with respect to margin requirements. Find below a quick summary; you can check this post to know the details.

Check complete details here.

Changes in margin requirements from Sep 1, 2020

When you open an account with Zerodha, you are opening a trading account which allows you to buy and sell shares on the stock exchanges (NSE, BSE), and a demat account with a depository (CDSL in our case) where you hold the stocks you own in electronic form. Exchanges and depositories work completely independently.

So when you buy shares, we receive the shares on your behalf from the exchanges which are then transferred to your demat account at CDSL. Similarly, when you sell shares, Zerodha debit it from your demat account and give it to the exchange. To debit shares from your demat account when you sell on the exchange, brokerage firms have until now taken a POA (power of attorney) over the demat account. This was the only way to allow for seamless online trading.

Otherwise, customers would need to transfer shares using a physical DIS slip (sort of a cheque for your demat account) to the broker before placing a sell order..

Generating the CDSL TPIN

You would have received the CDSL TPIN to your registered mobile and email address (from edis@cdslindia.co.in) with CDSL. If you haven’t received it, you can click here to generate it. Make sure to confirm that the correct email address and mobile are updated at CDSL by checking your profile on Console. Do remember this TPIN, as it would be required to authorise the sale of stocks with CDSL before you can place an order for them on Kite.

| Generate new CDSL TPIN | Change your existing CDSL TPIN |

Your portfolio can be comprised of:

Assets – Equity (stocks), Debt, Equity MFs/ETFs, Debt MFs, and Gold

Sectors – Financials, Energy, Materials, etc

Market-cap – Large-cap (top 100), Mid-cap (101-250), Small-cap (251 onwards).

Stocks – Reliance, HDFC, etc.

The Console holding visualization now lets you view your portfolio concentration across all of the above. Check more details here.

New rates

| Type of trade | New stamp duty rate |

|---|---|

| Delivery equity trades | 0.015% or Rs 1500 per crore on buy-side |

| Intraday equity trades | 0.003% or Rs 300 per crore on buy-side |

| Futures (equity and commodity) | 0.002% or Rs 200 per crore on buy-side |

| Options (equity and commodity) | 0.003% or Rs 300 per crore on buy-side |

| Currency | 0.0001% or Rs 10 per crore on buy-side |

Nothing changes for CNC or equity delivery trades that will require full funds in the trading account before placing a buy order or having securities in your Demat account before placing a sell order.

- Check this list to see the VAR+ELM margin requirement for all stocks.

- Zerodha Margin Calculator

Also, since NEFT is available on all days of the week and holidays, you needn’t wait until Monday for withdrawal requests placed on weekends anymore. We’ll be working on weekends and holidays to process these requests so you get credit on the same day.

Frequently Asked Questions

Zerodha is a Discount Broker.

Zerodha charges ₹200 (Trading +Demat) to open a trading account.

₹100

₹300

₹0 (Free)

₹20 per executed order or .01% whichever is lower

₹20 per executed order or .01% whichever is lower

₹0 (Free)

Yes. You can apply in IPO if you have a trading account with Zerodha.

Yes. You can trade in the equity segment with Zerodha.

₹20 per executed order or .01% whichever is lower

Yes. You can trade in the commodities at MCX with Zerodha.

₹20 per executed order or .01% whichever is lower

₹20 per executed order or .01% whichever is lower

₹20 per executed order or .01% whichever is lower

₹20 per executed order or .01% whichever is lower.

NSE ₹325 per Cr (0.00325%) | BSE ₹300 per Cr (0.003%) (each side)

Yes. You can buy/sell Mutual Fund if you have a trading account with Zerodha.

No. You cannot trade in bonds and NCD with Zerodha.

Yes. You can trade in the currency derivative segment with Zerodha.

Yes. Zerodha offers Bracket Orders (BO).

Yes. You can place ‘After Trading Hours’ Order with Zerodha. The After Hour Sessions enable you to place orders even when the market is closed. The timings of the After Hour Order varies by broker to broker. Most brokers allow to place the AMO orders between 3:30 PM to 9:00 AM on trading day and 24 hrs on the non-trading day (weekends or trading holidays).

No. Margin funding is not available when trading with Zerodha.

Kite Web, Kite Android/iOS, Pi, Coin, Kite mobile

Zerodha square-off intraday trades at 3:10 PM.

No. Zerodha doesn’t provide 24×7 customer service.

No. Zerodha doesn’t provide customer service through Chat service online.

Zerodha offers to trade at NSE, BSE, MCX, and NCDEX.