Difference between Direct Vs Regular Plan, Features, How to invest? & Which Plan is better?

The common appetite of the investors for saving the intermediary costs to get the maximum profits tends him/her to apply shortcuts of success and this nature of man calls for the Direct Plan.

Direct Mutual fund plan, as the name indicates, executes the plan of investment directly to operate in the stock market. Direct plan means a direct path to reach the destination directly without going through the mediums which come in between.

What is a Direct Plan in Mutual Fund?

Actually, the SEBI (Stock Exchange Board of India) had introduced two kinds of offers for the investors in the market. As you know that Mutual Fund generally attracts customers due to its nature of providing the assistance of well-versed professionals to them, so as per the new announcement by the SEBI 3 years back, it is left on the choice of the individual that whether he/she wants to take help from the professionals or not.

The name ‘Direct Plan’ is provided to give an identity to this SEBI’s one service.

The direct plan helps the investor to direct the investment process in the Mutual Fund according to his personal understanding. No more assistance by the MFs professionals is provided to him and thus the intermediary cost of the service provided by the experts is not charged by the investor.

If you remember that in our previous articles we had described you that there are various intermediary expenses involved in the whole Mutual Fund Investment tenure which includes the cost of distribution, broker charges, advisory charges, fund management charges and what not, which is together known as the ‘Expense ratio’. These expense charges are used to be compensated by the Investors.

When an investor chooses the direct plan then he has not to bear the professional and broker charges and thus comparatively he gets the better return than what he would get in regular plans. Steps in choosing the right mutual fund scheme.

Features of Direct Plans in Mutual Fund Schemes

- Direct Plans removes the involvement of brokers, advisors, professional expertise, fund managers, and trading expenses.

- One can directly apply for the investment via online connecting directly to the AMC.

- It is cost-effective as the investor can earn better on the purchase and sale of his securities.

- Direct plan outputs a better return to the investor. Generally, it returns 0.5% to 1.5% p.a on invested money.

- No charges on the transaction for lump sum investment or SIP investment is imposed as the transaction is done directly with the AMC.

- There would be a separate NAV (Net asset value) for direct plans. The scheme would denote “Direct” in its description at the end of such direct plans.

- SIP Or Lumsum Difference

- Best App to buy mutual funds

- Mutual Funds vs Stocks

What are you getting when you invest in a regular plan?

Like Direct plans, SEBI has opened similar but different option for the investors. It introduced a plan called the Regular plan which operates in the same manner like what you know and understood about the basic of Mutual Funds. Amm…you may be confused here. No worries, the coming Para will remove your confusions.

The regular plans operate normally according to the basic attractive features of what the Mutual fund carries with itself. The investors who chose regular plans for their investment are provided assistance from the professionals of the Stock field.

They not only guide them but also, they take the responsibility to better advice the investor along with managing their all funds and multiply their investment with the time being. In short, they take the complete headache of the investor and the investing business.

In lieu of all such services, the investor of the regular plan has to pay the cost for their services. Obviously, these professionals and service people are working on behalf of you as a nature of their occupation and every occupation outputs some salary. So the cost incurred by you becomes their cost of service.

Via Regular Plan you (as an investor) will get-

- Support from Mutual Fund houses like proper advice and management of your funds.

- Time to time acknowledgment about your gains and losses on your investment.

- Up to date knowledge about the new offers and schemes, taxations and exit loads.

- Fast access to the relevant investors who will either want to buy your funds or wishing to sell their funds to you.

Who chooses Regular Plan?

- Who is very new in the investment market.

- Who don’t have knowledge about what to invest and how to invest.

- Who doesn’t want to take a headache for handling their invested money all the time

- Who wants to focus on their other core issues.

- Who can compromise a little with the difference in returns as compared to what they can get via the direct plan?

- What is Systematic Investment Plan (SIP)?

How Direct Plan is better than the Regular Plan in Mutual Fund

The topic heading is calling for a differentiation war between the direct plan vs Regular Plan.

See, both plans play a significant role in their places and they both have their own unavoidable benefits. Let us first see how they are significant separately and then we will come to some conclusion. OK?

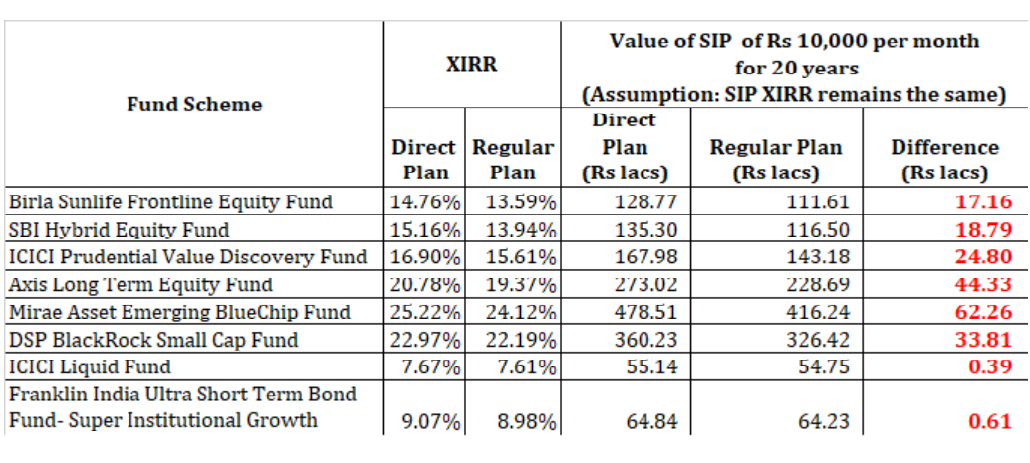

From the above image, you can conclude that Direct Plan has proven itself better than the Regular plans in case of top Mutual Fund Houses. How it becomes better, we will see the reasons now.

- The direct plan is meant for Do-It-Yourself Investors. The investors who have the skills to understand the stock Mutual Fund market and has the knowledge for where to invest, how to handle the investment, then that person should surely go with the Direct plans. Because these individuals seriously don’t require the need of professionals as they themselves are professionals.

Regular plans are meant for Registered Investment Advisor. The investors of Regular plan take help from the advisors who can advise them better on investment activities. On every step, right from choosing the investment plan till its management even at the maturity period, these investors are provided full on support by the professionals.

- The Direct plans, due to the absence of intermediaries in between become cheaper and hence it becomes cost-effective for the direct plan investor. He has not to pay the intermediaries.

The regular plan investor has to pay the cost of services to each intermediary in between and therefore, the cost of his investment become more.

- The rate of returns on investment in case of Direct Investment is much -much better because after getting the profit on returns, no payment is deducted to compensate the cost of intermediaries.

This is reversed in the case of regular investors. The rate of returns is comparatively lower. They did not get that much what they may be expecting because 1/4th of the profit is deducted in order to pay the professional’s cost of services.

- Indirect plans, all documentation activities need to be completed by the investors himself whereas, in a regular plan, the investor transfers this entire headache to his Mutual Fund agent.

- The direct plan holder cannot take single advice from the experts in times of inflation or doubtful conditions. The regular plan holder is free from such headaches.

What will be the difference in return over a long term, say 15 years?

Are you looking this image?

This image is showing you the tendency of the Direct plan to reach the heights in the upcoming 15 years.

No doubt it provides the investor better returns but the condition is that the investor should have proper knowledge and skills to operate in the stock market.

As per the assumption by famous trade groups, in the upcoming 15 years, the value of Direct plans can jump to 10-15% value as compared to the Regular plans which may show its value between 10-12%.

Although the return percentage value is not showing a much difference in the stock market, a single point difference makes a huge difference in the earnings of an individual.

How to invest in Direct Plans?

- To execute the direct plan, one has to fill a form via the internet.

- You have to first identify that with which Fund House, you want to work with.

- Then, go to that Fund House’s official website.

- Select Mutual Funds scheme from there and fill the required form yourself.

- Enter all the necessary details.

- Make sure that the form is meant for the direct plan only.

- Submit the form.

- You have been registered for the direct plan investment now.

How to invest in Regular Plans?

To choose a Regular plan for your investment, you can select the online medium also and the offline medium as well.

But, as you know that a total headache regarding your registration with the Fund house and investment is carried by the professional hired by you, so it is his duty and responsibility to execute every registration operation. It is totally up to him that whether he will register through an online process or the offline process.

The online process will go the same as what has discussed above. For offline medium, the investor or the hired professional has to do all documentation services manually.

- He manually has to visit the desired Mutual Fund house.

- He has to carry the investor’s PAN card and his KYC.

- A registration form is handed to the interesting individual and that form is to be filled nicely.

- Also, he has to attach the PAN card and KYC copy with the form and submit it to the Fund House.

- In this way, the investor got registered.

| How to Invest in Share Market? | Best Discount Broker in India 2019 |

| What is IPO and its process? | How to open Demat Account? |

Conclusion-

The investment in direct plan proves a better option than the regular plan because it provides you nearly 0.75% to 1.5% higher returns than the returns offered by the Regular plan.

It is all about the returns which motivates the investor to invest in schemes and when it is clearly visible that direct plan returns a better profit, then who will not wish to opt this channel. Right?

I hope the above-provided information about Direct Vs Regular mutual funds plan is helpful for you. You can reach us through the comment section mentioned below.

Thanks for reading!