How to Apply IPO through SBI Net Banking? Step by Step Guide

Howdy Investors 🙂 Wassup!

Nowadays, there is a huge cascade of IPO. IPO stands for initial public offering. An initial public offering refers to the procedure of proffering shares of the public companies to the public in new stock issuance.

The transformation from private to public is a significant phase for the private investors to completely realize profits from their investment as it totally involves share premiums for current premium investors.

Our today’s post is customized for How to apply IPO through SBI bank?

The article explains the procedure to purchase the IPO online in SBI bank.

ASBA stands for Application Supported by Blocked Amounts. Check How to apply IPO through ASBA? This system is certain that the amount required to apply for an IPO is blocked in the selected savings account, without being debated.

Only in the case of allotment is the amount finally debited.

So, without any ado, let’s get started

Prerequisites for SBI ASBA

Prerequisites for Apply IPO via State Bank of India – SBI Net Banking (ASBA):

- The investor is required to have a bank account with the State Bank of India.

- You required to have a Demat account (not necessarily with SBI), the investor should have the Demat details such as the name of the DP, whether the Demat account is with NSDL or CDSL.

How to buy IPO Online in SBI bank?

SEBI (Security Exchange boards of India) has apprised the checklists of the banks via which the retail investors can apply online for any of the upcoming IPO.

These banks are known as SCSBs. The state bank of India is one of the members of the SCSBs which permits the account holder to make an application for an initial public offering IPO Through SBI net banking.

Steps to Online IPO Application through SBI

The procedure for applying IPO via the SBI bank involves 6 steps

- Login to your SBI online account

- Click on e-Services Tab

- Now click on ‘Demat and ASBA services’

- Click on ‘IPO Equity’

- Select the IPO you wish to apply from the list

- Enter IPO details

- Verify and Confirm the details.

- How to Apply IPO through HDFC Netbanking?

- How to Buy IPO through Zerodha Kite?

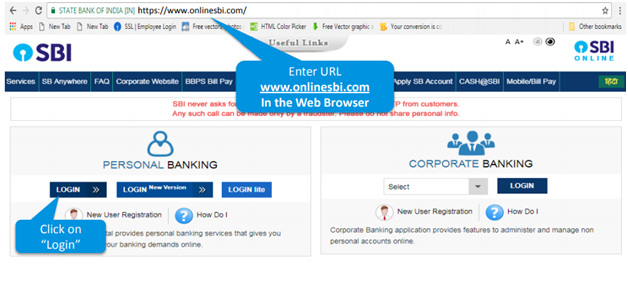

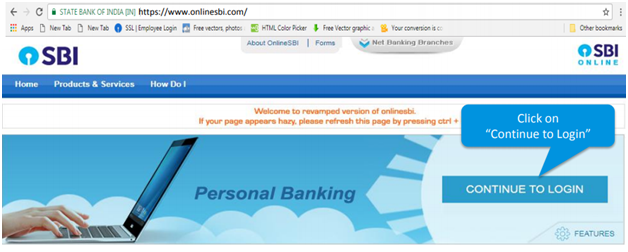

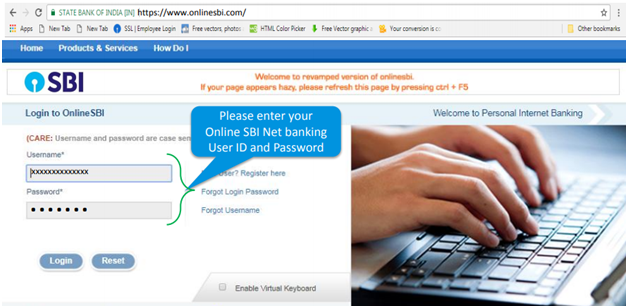

1.Login to your SBI online account

On the login page, an investor is required to enter the netbanking user ID and the password

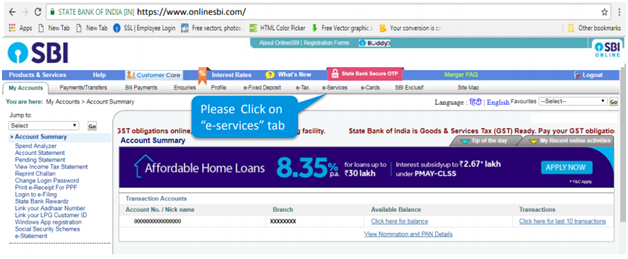

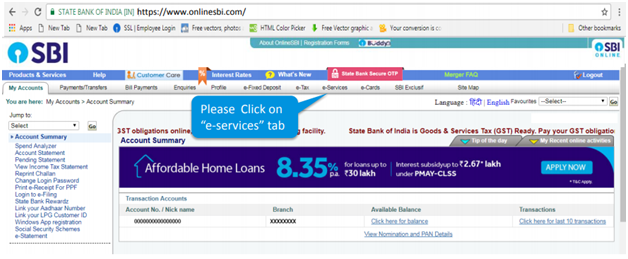

2. Click on the e-services tab

In your accounting page, click on the e-services tab

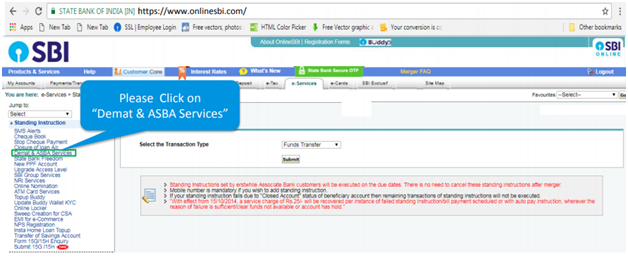

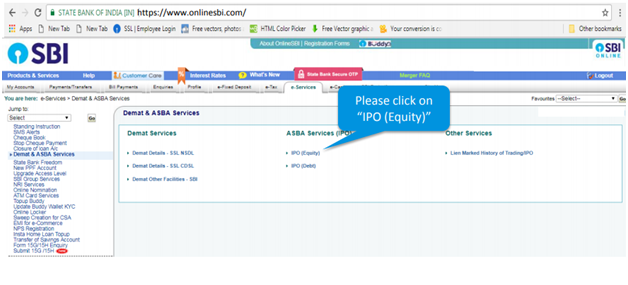

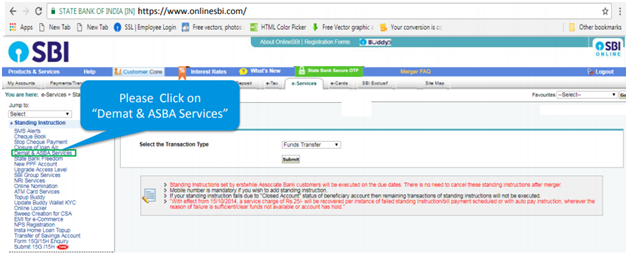

3. Click on ‘Demat and ASBA services’

Now click on the DEMAT and ASBA services in the menu displaying on the left side of the screen

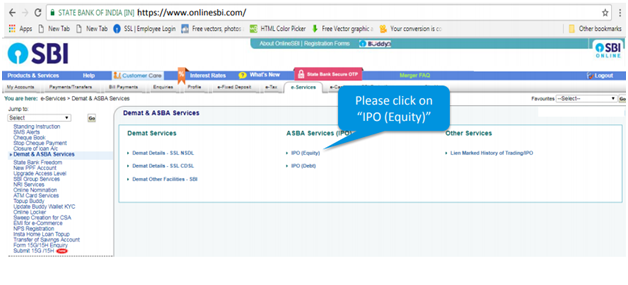

4. Click on ‘IPO Equity’

on the DEMAT and ASBA services” page, there will be three sections, Demat services, ASBA services, and other services

Under the ASBA services, you have to click on the “IPO equity” and click on the accept” after reading the terms and condition

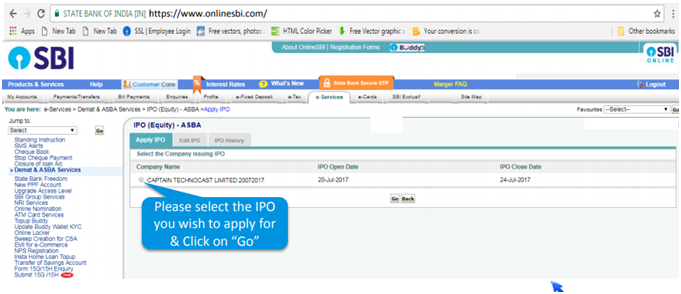

5. Now select the IPO you wish to apply from the list

The IPO equity-ASBA will present you with the list of the companies that are issuing IPO at that time with open and closing date of bidding.

Pick the IPO you wish to apply and click on the “Accept button”

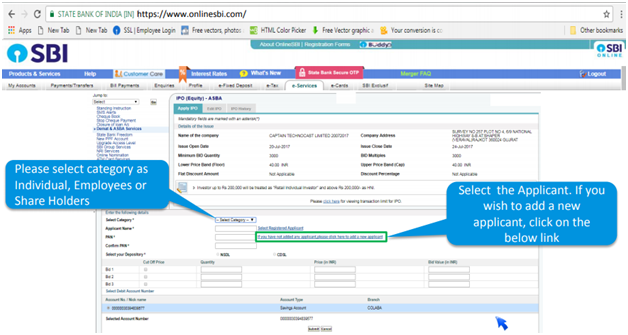

6. Enter IPO Details

You have to fill in the form wherein you are required to mention applicant and IPO details such as like minimum bidding quantity, price of each share, IPO open and closing date, etc.

The initial details you are required to fill in is the category. You will be given three option that is

- Individual

- Employee

- Shareholders

The second detail you are required to enter the applicant. If you added yourself as an applicant then you are required to select an applicant’s name.

Once the applicant is selected, other key details such as PAN card details, depository name will be filled

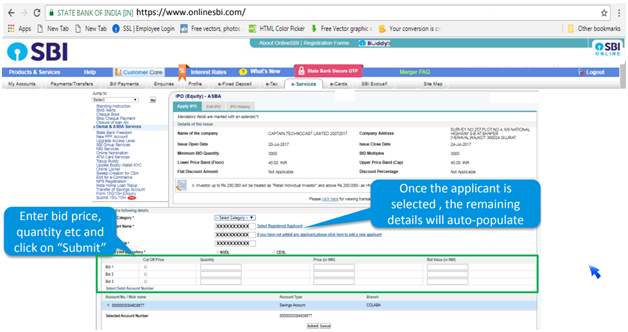

You have to fill other IPO details such as quantity, bid price, etc. There is also a checkbox for ” Cut off” Price.

The option is for the retail investor and is handy for book building issues where in place of the fixed price, a price range is provided by the company

Investors are required to bid within range. Clicking on the “cut off-price” means that you have to approve to accept the allotment at the price decided by the company.

This saves you from the bidding race and makes sure that you don’t lose on allotment due to the lower bidding price

Enter the details and click on the submit

Once you click on the submit, you will be taken into the IPO confirmation page. The page will contain the list of IPO successfully applied

Conclusion

You have successfully applied for IPO through SBI ASBA online application method.

| Tips for Investing in IPO | How to Invest in Share Market? |

| Best Stock Trading Apps 2020 | What are NIFTY and SENSEX? |

| Grey Market Premium of IPO | Intraday Trading Basics |

How to Apply IPO through Zerodha & Upstox?

SBI ASBA Eligibility Criteria

Who can apply for an IPO online through SBI Bank net banking?

You can apply for the IPO through SBI, in case

- Above the age of 18 years

- Saving or account holders in the bank

- Hold the single or joint account with the bank

- Have Demat account with NSDL or CDSL

- Have funds more than the application amount in the accounts.

FAQ’s

Q. Can I apply online for IPO through SBI net banking?

Yes, one can apply for an IPO through SBI net banking as SBI is a member of SSCBs (Self-certificate syndicate banks. SSCBs are permitted by SEBI to accept online IPO applications from investors.

Q. How to edit ASBA IPO details in SBI bank?

The investor can only edit the details of IPO which is open for bidding. To edit IPO details in SBI bank, take the following steps

Click on “e-Services” Tab on the menu.

Now, on the left-hand side, click on “Demat & ASBA services”

Q How many application one can make while applying for the IPO using the SBI net banking?

The investor can make only one application with three bids on that application

Q When is the application amount blocked when applying for the IPO is released in the SBI bank?

the blocked application money will be released on the next working day of allotment finalization

Q. Can I apply for an IPO through SBI mobile app?

No, SBI mobile app currently does not offer this convenience to apply for IPO via the SBI mobile app.

Q How to sell IPO shares bought through SBI ASBA?

The SBI provides the facility to the investors to apply for the IPO. Once you receive the allotment the shares will immediately be credited with your Demat account.

by the time the company gets listed, the shares are all set for trading on NSE and BSE EMERGE or BSE SME for SME IPOs.

The investor is required to have a trading account to sell your shares purchased through an IPO

It is to be noted that the procedure for selling the IPO shares will be the same as any other shares

Q. How to add new applicant for SBI ASBA IPO online application?

To insert a new applicant for SBI ASBA IPO online application

You are required to

- Visit www.onlinesbi.com and log in using your user id and password

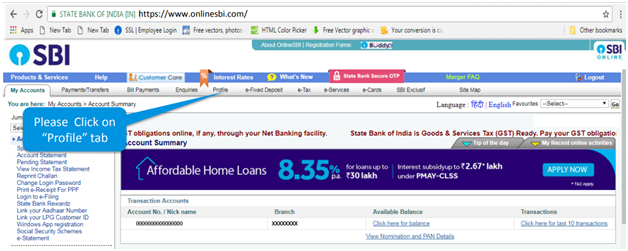

- Click on the profile tab

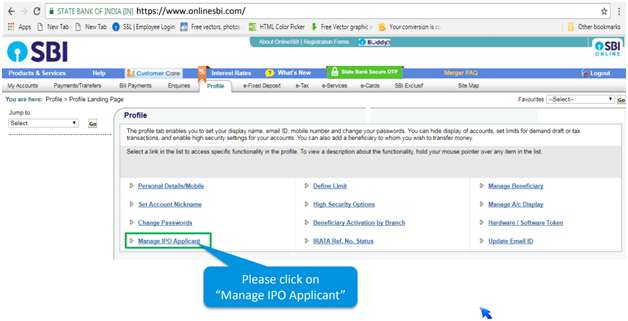

what you need to do is, on the profile page, click on the Manage IPO Applicant. Then you will be asked to enter the NetBanking password on clicking on it

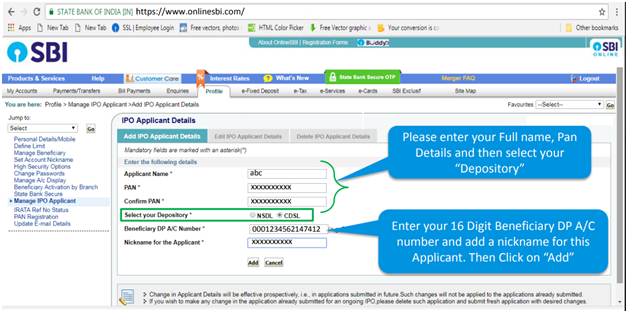

On the applicant details page, fill in the necessary details such as PAN, depository, DP A/C number, and a nickname. Click on “Add”.

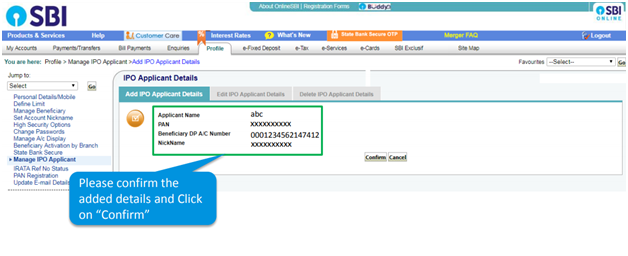

You need to cross check the applicant details deliberately and then proceed to Confirm button

Final Words

I hope the above guide on How to Apply IPO through SBI Net Banking? has been proved useful.

if you have any queries, suggestion or views regarding the IPO through SBI please feel free free to reach out to us.

We are available round the clock to escalate your issues and queries.

We at Investor’s academy aims at delivering Top-notch information on finance topics which include Fixed income, mutual funds, NCDs, and Mutual funds.

If you like it, do share it with others via Twitter and Facebook.

Like, share and subscribe us. stay tuned for another hot update on your very own investors’ Academy

Thanks for Reading.

जी, आपने बहुत विस्तार से समझाया, धन्यवाद। आज कल ipo upi id माध्यम से ना कि ASBA से ,ध्यान रखना। 1st july 2019 onwards only with UPI ID, no asba am I correct please.

You can also apply with ASBA with Internet banking today.

UPI is only for manual IPO applications.

Can I apply three applications in the name of my family members from my bank account through ASBA? All have separate PAN numbers.

No Parmar, You can only apply only one application from one account of yours. For family members, you must apply through their own bank accounts OR Via UPI Id.

sir, if a person has more than one Dmat- account, then in which D- mat acciunt ,the IPO will be transfer

Hi, Neeraj

IPO Allotment ke baad shares usi Demat me aaenge Jo DP ID aapne IPO apply krte time di thi.

I have a saving bank account in SBI with joint other two name i.e. my wife and my son . I have three individual demat account in PL, and all the demat account linked with same one bank account. Kindly advice me can we apply for IPO from said single bank account.

Yes kalpana you can apply. But for more safety you should open different account for all.