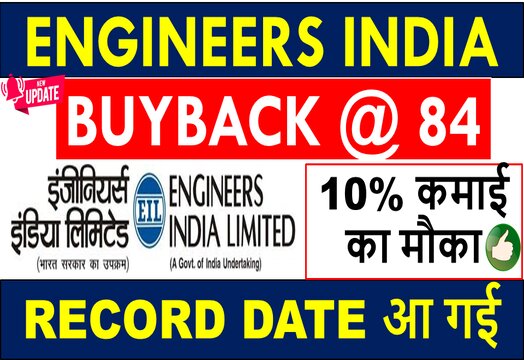

Engineers India BUYBACK 2021 | LATEST Engineers India SHARE NEWS | EIL BUY BACK RECORD DATE | Engineers India BUYBACK PRICE | Government Companies Buybacks

Engineers India (EIL) shareholders approve ₹587 crore share buyback plan.

Engineers India has announced the record date for carrying out nearly 6.99cr share buyback plan. The company has set January 01, 2021, as the record date for determining eligible shareholders.

The company had announced a buyback of up to 6,98,69,047 equity shares having a face value of Rs 5 each.

It is further notified that the Company has fixed January 1, 2021 as the record date for the purpose of ascertaining the eligibility of shareholders for Buyback of equity shares.

Engineers India Share Buyback Offer Details

EIL Share Buy Back Plan | Latest Engineers India Stock News | Engineers India Buyback Shares

| Engineers India Buyback Type: | Tender Offer |

| Engineers India Buyback Record Date: | Jan 1, 2021 |

| Engineers India Buyback Offer Amount: | ₹579 crore |

| Date of Board Meeting approving the proposal: | DEC 21, 2020 |

| Date of Public Announcement: | DEC 22, 2020 |

| EIL Buyback Offer Size: | 11.06% |

| Buyback Number of Shares: | 6,98,69,047 |

| Price Type: | Tender Offer |

| Face Value (FV): | 5 |

| Engineers India Buyback Price: | ₹84 Per Equity Share |

| Engineers India Buyback Premium: | 10% |

The government of India holds a 51.50 per cent stake in the firm that provides engineering consultancy for projects.

The government has asked at least eight state-run companies to consider share buybacks as it scours for ways of raising funds to rein in its fiscal deficit.

The government wants public sector undertakings to either meet their targets for capital expenditure or “reward the shareholder in the form of a dividend” or share buyback.

Also Check:- Latest Share Buyback 2021

Upcoming Buyback 2021

INVESTOR ACADEMY ? is now on Telegram. Click here to join our channel and stay updated with the Latest Dividends, IPOs news and stock market updates.

Engineers India Buyback Important Dates

In this section we have covered all important dates related to “EIL Buyback Date”. Dates are updated as they are announced. The most noted dates are Engineers India record date and Engineers India buyback open and close dates, which one should use to participate in buyback.

| Buyback Activity | Date |

|---|---|

| Board Meeting for EIL Buyback proposal | 21.12.2020 |

| Engineers India Buyback Approval date | 22.12.2020 |

| Public Announcement of EIL Buyback | 22.12.2020 |

| Engineers India Buyback Record Date | 01.01.2021 |

| Engineers India Buyback opens on/Buyback Opening Date | 22.01.2021 |

| Engineers India Buyback closes on/Buyback Closing Date | 05.02.2021 |

| Cut-off date to receive completed tender forms by Registrar | 08.02.2021 |

| Cut-off date for verification by the Registrar | 10.02.2021 |

| Cut-off date to inform Stock Exchange on acceptance or non-acceptance of tendered Equity Shares by Registrar |

12.02.2021 |

| Last date of settlement of bids on the stock exchange | 15.02.2021 |

| Last date to return unaccepted shares by Registrar | 15.02.2021 |

| Last date of extinguishment of Equity Shares | 22.02.2021 |

| UPCOMING IPO | Best Stocks to buy | UPCOMING DIVIDEND |

| UPCOMING NCD | UPCOMING BONUS | UPCOMING Buybacks of Shares |

Engineers India Share Holding Pattern as of SEP 2020

Stock Holding table gives a clear picture on retail investor holdings of EIL shares which helps investor to decide on participating in buyback offer. The less number of retail holdings means higher chance of acceptance in Engineers India buyback under retail category which is equal to higher profit.

Shareholding Pattern – Engineers India Ltd. (EIL Ltd.)

| Category | No. of shares | Percentage |

|---|---|---|

| Promoters | 325404724 | 51.5 |

| Foreign Institutions | 27964948 | 4.43 |

| NBFC and Mutual Funds | 94870829 | 15.01 |

| Central Government | 2,996,756 | 3.41 |

| Others | 21524509 | 1.13 |

| General Public | 111784961 | 17.69 |

| Financial Institutions | 50361449 | 7.97 |

Engineers India Buyback Record Date

Tentative Record Date To Participate In EIL Buyback is January 1, 2021

How to Apply for Engineers India Buyback?

Now if you are wondering ‘how do I apply for a buyback?’ we’ve got you covered. When it comes to share-buyback schemes, the capital market regulator has compulsorily reserved a buyback portion of 15% for retail investors who possess in-hold shares in a company worth upto ₹2 lakhs.

This percentage is also taking into account the scrip’s market value as seen on the record date of the buyback offer.

During the application process of share buyback, you will be given a tender form by the company. This form is where you enter the number of shares of that company that you wish to tender.

There is a ratio of acceptance attached to the tender form which signifies how likely the company is to accept your request for share buybacks. Different companies have different ratios for share buybacks.

Here is what you can expect in a typical tender form given by a company. There are normally three fields as follows:

- The number of shares you hold from the said company as on the record date

- The number of shares that fit the eligibility criteria for buybacks

- The number of shares that one is applying for a buyback.

Apply Engineers India buyback from Zerodha

Here is complete method from Zerodha

- Hover your mouse on the stock and select ‘Options’ and click on ‘Place order’

- Enter the number of shares you want to tender and click on ‘Submit’

- Buyback/Takeover/Delisting orders are collected until 6:00 PM, one trading day prior to the offer end date. Ensure to hold sufficient quantities in your demat account before closure of the offer end date. (Do not sell the shares after placing the order). Only shareholders who hold the shares as on the record date will be eligible for the corporate action.

Latest & Upcoming Buybacks 2021

| TCS Buyback | NIIT Ltd Buyback | WIPRO Buyback |

| NMDC Buyback | GAIL Buyback | Ajanta Pharma Buyback |

| HPCL Buyback | NTPC Buyback | IIFL Securities Buyback |

Engineers India Buyback Acceptance Ratio

Profit from the buyback on the bases of acceptance Ratio:

Buy 2631 Shares at CMP of Rs.76 (2,00,000/76=2631)

| EIL Buyback Acceptance Ratio | 33% | 50% | 75% | 100% |

| Amount Invested in Buyback | 199956 | 199956 | 199956 | 199956 |

| No. of Shares buyback | 868 | 1315 | 1973 | 2631 |

| Buyback Profit | 9644 | 10520 | 15784 | 21048 |

| Profit | 4.82% | 5.26% | 7.89% | 10.52% |

Here is what you can expect in a typical tender form given by a company. There are normally three fields as follows Engineers India Buyback Acceptance Ratio:

- The number of shares you hold from the said company as on the record date

- The number of shares that fit the eligibility criteria for buybacks

- The number of shares that one is applying for a buyback.

Company Contact Information

COMPLIANCE OFFICER

Suvendu Kumar Padhi, Company Secretary

Engineers India Bhavan, 1, Bhikaji Cama Place, New Delhi, 110066

Tel: +91 11-26762121; Fax: +91 11-26178210

Email: company.secretary@eil.co.in

Website: www.engineersindia.com

Investor may contact the Company Secretary for any clarification or to address their grievances, if any, during office hours i.e. 10:00 a.m. ISTto5:00 p.m. 1ST on all working days except Saturday, Sunday and public holidays.

Download PDF of Engineers India Buyback Offer

Registrar Contact Information

In case of any query, the shareholders may contact the Registrar & Transfer Agent on any day except Sunday and Public

Holiday from 10:00 a.m. IST to 5:00 p.m. IST i.e. Monday to Friday and from 10:00a.m. IST to 1:00 p.m. 1ST on Saturday, at the following address:

AUNKIT ASSIGNMENTS LIMITED

205-208, Anarkali Complex, Jhandewalan Extension, New Delhi -110055

Tel: +91 11 42541234/2354; Fax: +91 11 23552001

Contact Person: Mr. VirenderSharma

Email: eilbuyback@alankit.com; Website: www.alankit.com

SEBI Reg No: INR000002532 Validity Period: Permanent

CIN: U74210DL1991PLC042569

***Related Queries***

Engineers India Buyback Important dates – Record Date, Buyback Start and End date. Buyback Details – Buyback Price, Buyback Offer Size, Buyback Number of Shares, Retail Investors limit. What is the record date for Engineers India buyback? How can I apply in Engineers India Buyback offer?

Engineers India share buyback, EIL buyback, Engineers India share buyback news, Engineers India share latest news, Engineers India share news, Engineers India share price today, Engineers India share price, Engineers India stock latest, EIL buyback news, Engineers India share target, Engineers India January 1, Engineers India buyback, Engineers India buyback date, Engineers India buyback important date, Engineers India buyback, Engineers India share news.

Engineers India Buyback 2020 FAQs:

Engineers India buyback 2020 record date will be January 1, 2021.

Engineers India buyback 2021 announcement date is December 22, 2020.

The company has fixed the price at ₹84 Per Equity Share.

As per the Engineers India record date (01.01.2021) you need to have Engineers India shares in your demat account. You can participate in buyback after having the stock in your account.

Once you have shares in demat, you can participate in the buyback process which is opening from [Not Announced], by selling your shares through your broker on NSE or BSE. Then on [Not Announced] the payment will be given to you for accepted shares and unaccepted shares will be returned to your demat account.

Its all depend on Engineers India acceptance ratio which usually announce with Letter of Offer.

The percentage of proportionate acceptance varies from company to company. This percentage can be also 100% which means that company buys all of your shares.

Steps to participate in Engineers India buyback:

On Record date (01.01.2021) you must have share of Engineers India in your demat account. Depositing of share in your DP account usually take T+2 days, so you need to plan your buying accordingly.

After that company announces buyback open and close window, so you need to tender your share in buyback process. You can do this online or contact your broker to tender your share in buyback, so he can place a request on your behalf.

Next step is with registrar – depend on buyback acceptance ratio, your shares will be sold in buyback process and fund will directly debited in your bank account. Any rejected share will be revert in your demat account which you can sell in open market or hold for long term gain.

Share holders who hold less than 2 lakh worth of shares are consider in Retail Category. All others will consider in General Category. Last trading price on record date will be used to calculate the eligibility criteria.

Engineers India Buyback opening date: (Coming Soon)

Engineers India Buyback closing date: (Coming Soon)

This is the window when you need to submit your application for proposal for share buyback.

As this is a buyback tender offer, shares are accepted in proportionate basis. Proportionate acceptance / rejection will be returned back to the eligible shareholders directly by the Registrar on or before (Coming Soon).

Engineers India plans to buy back up to 6,98,69,047 equity shares of the company for an aggregate amount not exceeding 587 crore. Engineers India proposed to buy back shares at ₹84 per share.

The company had announced the mega buyback offer as part of its long-term capital allocation policy of returning excess cash to shareholders.